Noticias e investigaciones antes de que te enteres en CNBC y otros. Solicite su prueba gratuita de 1 semana para StreetInsider Premium aquí.

ESTADOS UNIDOS

COMISIÓN NACIONAL DEL MERCADO DE VALORES

Washington, D.C.20549

FORMAR N-CSR

CERTIFICADO

INFORME DE ACCIONISTAS DE REGISTRADOS

GESTIÓN DE EMPRESAS DE INVERSIÓN

Número de archivo de la Ley de Sociedades de Inversión 811-21477

Fondo de ingresos y oportunidades vinculados a la inflación de activos occidentales

(Nombre exacto del registrante como se especifica en la carta)

620 octavo

Avenue, 49th Floor, Nueva York, NY 10018

(Dirección de las oficinas ejecutivas principales) (Código postal)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 Primer lugar de Stamford

Stamford, CT 06902

(Nombre

y dirección del agente para el servicio)

Número de teléfono del registratario, incluido el código de área: (888) 777-0102

Fecha de fin del año fiscal: 30 de noviembre

Fecha del período del informe: 30 de noviembre de 2019

| OBJETO 1. |

INFORME A LOS ACCIONISTAS. |

los Anual Se presenta un informe a los Accionistas.

| Reporte anual | 30 de noviembre de 2019 |

ACTIVO OCCIDENTAL

ENLACE INFLADO

OPORTUNIDADES Y

FONDO DE INGRESOS (WIW)

A partir de enero de 2021, según lo permitido por las regulaciones adoptadas por la Comisión de Bolsa y Valores, el Fondo

tiene la intención de dejar de enviar copias impresas de los informes de accionistas del Fondo como este, a menos que solicite específicamente copias impresas de los informes del Fondo o de su intermediario financiero (como un corredor de bolsa o banco). En lugar,

los informes estarán disponibles en un sitio web, y se le notificará por correo cada vez que se publique un informe y se le proporcione un enlace al sitio web para acceder al informe.

Si invierte a través de un intermediario financiero y ya eligió recibir informes de accionistas electrónicamente ("Entrega electrónica"), este cambio no lo afectará y no necesita tomar ninguna medida. Si aún no has elegido entrega electrónica, puedes elegir recibir

informes de accionistas y otras comunicaciones del Fondo electrónicamente contactando a su intermediario financiero.

Puede elegir recibir todos los informes futuros en papel de forma gratuita. Si invierte a través de un intermediario financiero, puede comunicarse con su intermediario financiero para solicitar que continúe recibiendo copias en papel.

de sus informes de accionistas. Esa elección se aplicará a todos los fondos de Legg Mason en su cuenta en ese intermediario financiero. Si es accionista directo del Fondo, puede llamar al Fondo al 1-888-888-0151, o escriba al Fondo por correo postal a P.O. Box 505000, Louisville, KY 40233 o por entrega nocturna a Computershare, 462 South 4th Street, Suite

1600, Louisville, KY 40202 para informar al Fondo que desea continuar recibiendo copias en papel de sus informes de accionistas. Esa elección se aplicará a todos los fondos de Legg Mason en su cuenta mantenida directamente con el complejo de fondos.

| PRODUCTOS DE INVERSIÓN: NO ASEGURADOS POR LA FDIC • SIN GARANTÍA BANCARIA • PUEDE PERDER VALOR |

Objetivos del fondo

El objetivo principal de inversión del Fondo es proporcionar ingresos actuales. La apreciación del capital, cuando es consistente con el ingreso actual, es un objetivo secundario de inversión.

Estimado accionista,

Nos complace proporcionar el informe anual de Western Asset Inflation-Linked Opportunities & Income Fund para el informe de doce meses

período finalizado el 30 de noviembre de 2019. Siga leyendo para obtener una visión detallada de las condiciones económicas y de mercado prevalecientes durante el período de presentación de informes del Fondo y para saber cómo esas condiciones han afectado el rendimiento del Fondo.

Como siempre, seguimos comprometidos a brindarle un excelente servicio y un espectro completo de opciones de inversión. También seguimos comprometidos a complementar el

Apoyo que recibe de su asesor financiero. Una forma de lograr esto es a través de nuestro sitio web, www.lmcef.com. Aquí puede obtener acceso inmediato a información de mercado e inversión, que incluye:

| • |

Precios del fondo y rentabilidad, |

| • |

Perspectivas de mercado y comentarios de nuestros gerentes de cartera, y |

| • |

Una gran cantidad de recursos educativos. |

Miramos

Esperamos poder ayudarle a alcanzar sus objetivos financieros.

Sinceramente,

Jane Trust, CFA

presidente

31 de diciembre de 2019

|

|

||

| II | Fondo de ingresos y oportunidades vinculados a la inflación de activos occidentales |

P. ¿Cuál es la estrategia de inversión del Fondo?

A. El objetivo de inversión del Fondo es proporcionar ingresos actuales. La apreciación del capital, cuando es consistente con el ingreso actual, es un

objetivo de inversión secundaria. En condiciones normales de mercado y en el momento de la compra, el Fondo invertirá al menos el 80% de sus activos gestionados totalesyo en valores vinculados a la inflación. El Fondo también puede invertir hasta el 40% de sus activos gestionados totales en un grado de inversión inferior

valores. El Fondo puede invertir hasta el 100% de sus activos gestionados totales en no estadounidense inversiones en dólares que le dan al Fondo flexibilidad para invertir hasta el 100% de sus activos administrados totales en no estadounidense valores vinculados a la inflación en dólares (hasta el 100% de su no estadounidense la exposición al dólar puede no estar cubierta). El Fondo puede participar en estrategias monetarias, utilizando instrumentos como

Forwards de divisas, futuros y opciones, para tomar posiciones en moneda extranjera largas y cortas sujetas a un límite de exposición de dichas estrategias al 40% del total de los activos administrados. Esta capacidad se suma a la capacidad de tener una exposición 100% sin cobertura

a no estadounidense monedas en dólares mediante la compra de valores de renta fija. El Fondo puede utilizar estrategias relacionadas con productos básicos para hasta el 10% de sus activos administrados totales. Se espera exposición a productos básicos

se logrará utilizando una variedad de instrumentos, como contratos de futuros, opciones y otros derivados, o mediante inversiones en productos negociados en bolsa que ofrecen exposición a productos básicos. El Fondo no espera mantener productos físicos.

Cada una de las políticas anteriores es un no fundamental política que puede modificarse sin la aprobación de los accionistas. los

El fondo también tiene lo siguiente no fundamental política, que, en la medida requerida por la ley aplicable, solo puede cambiarse después de avisar a los accionistas: en condiciones normales de mercado, el Fondo invertirá en

al menos el 80% de sus activos administrados totales en valores protegidos contra la inflación y no protegido contra la inflación valores e instrumentos con potencial para mejorar los ingresos del Fondo. El Fondo puede invertir hasta

20% de la cartera en instrumentos de deuda de emisores de mercados emergentes, que no son valores vinculados a la inflación.

Recompra inversa

los acuerdos y otras formas de apalancamiento no excederán el 38% del total de los activos administrados del Fondo. El Fondo actualmente espera que la duración efectiva promedioii de su cartera oscilará entre cero y quince años, aunque esta duración objetivo puede cambiar de vez en cuando. El fondo

puede celebrar contratos de swap de incumplimiento crediticio, contratos de swap de tasa de interés, swaps de índice de precios al consumidor y contratos de swap de rendimiento total para fines de inversión, para administrar su tasa de interés de riesgo de crédito y exposición, cobertura o riesgo de riesgo vinculado a la inflación

para agregar apalancamiento. No puede garantizarse que el Fondo logrará sus objetivos de inversión.

El Fondo busca ofrecer un

cobertura de la inflación a través de inversiones en valores globales vinculados a la inflación, y principalmente en valores del Tesoro de EE. UU. protegidos contra la inflación ("TIPS")iii. El Fondo también busca ofrecer a los accionistas ciertas ventajas adicionales a través de la capacidad de invertir en otros ingresos fijos

clases de activos, que pueden dar como resultado retornos totales más altos y tasas de distribución más altas. Estas clases de activos incluyen inversiones selectas en crédito de alto rendimiento y grado de inversión, mercados emergentes y productos estructurados.

|

|

||

| Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual | 1 |

Resumen del fondo (cont.)

En Western Asset Management Company, LLC ("Western Asset"), el Fondo

asesor de inversiones, utilizamos un enfoque de equipo de renta fija, con decisiones derivadas de la interacción entre varios especialistas del sector de gestión de inversiones. Los equipos del sector están compuestos por la gerencia de cartera senior de Western Asset

personal, analistas de investigación y un en la casa economista. Bajo este enfoque de equipo, la gestión de las carteras de renta fija de los clientes reflejará un consenso de puntos de vista interdisciplinarios dentro del activo occidental

organización. Los individuos responsables del desarrollo de la estrategia de inversión, día a día La gestión de la cartera, la supervisión y la coordinación del Fondo son S. Kenneth

Leech, Michael C. Buchanan, Frederick Marki y Chia-Liang Lian.

P. ¿Cuáles fueron las condiciones generales del mercado durante el Fondo?

¿período de información?

A. Los mercados de renta fija generalmente registraron buenos resultados durante el período de doce meses finalizado

30 de noviembre de 2019. Sectores extendidos (no bonos del Tesoro) experimentaron períodos de volatilidad, ya que se vieron afectados por una serie de factores, que incluyen la moderación del crecimiento global, el endurecimiento de la política monetaria y luego un

"Pivote moderado" por la Junta de la Reserva Federal (la "Fed")iv,

la guerra comercial en curso entre los EE. UU. y China, las incertidumbres que rodean el Brexit y muchos otros problemas geopolíticos.

Tanto a corto como a largo plazo

Los rendimientos del Tesoro de EE. UU. Disminuyeron durante el período del informe. El rendimiento para el dos año La nota del Tesoro comenzó el período del informe en 2.80% (el pico para el período de informe) y terminó el período en 1.61%. los

mínimo para el período del informe fue del 1,39% el 3 de octubre de 2019. El rendimiento para el diez años El Departamento del Tesoro comenzó el período del informe en 3.01% (el pico para el período de informe) y terminó el período en 1.78%. los

El mínimo para el período del informe fue 1.47% el 28 de agosto, 3 de septiembre y 4 de septiembre de 2019.

La inflación fue relativamente

bien contenido durante el período del informe. Para los doce meses terminados el 30 de noviembre de 2019, la tasa de inflación desestacionalizada, medida por el Índice de Precios al Consumidor para Todos los Consumidores Urbanos

("CPI-U")v, fue del 2,1%. los CPI-U menos comida y energía fue de 2.3% en el mismo período de tiempo. CONSEJOS, según lo medido por el índice Bloomberg Barclays de bonos vinculados a la inflación del Tesoro de EE. UU. ("TIPS")vi, devolvió 8.61% durante el período de informe.

P. ¿Cómo respondimos a estas condiciones cambiantes del mercado?

A. UN

Se realizaron varios ajustes en la cartera del Fondo durante el período de referencia. El portafolio general

duraciónvii se gestionó activamente en respuesta a los cambios en el sector extendido y

Rendimientos de tesorería. La ampliación de los rendimientos de la deuda de los mercados emergentes en relación con los bonos del Tesoro de EE. UU. Nos permitió aumentar la exposición del Fondo a la deuda de los mercados emergentes a niveles atractivos en relación con los bonos del Tesoro, ya que este último se recuperó durante el verano.

Los rendimientos del Tesoro real no cayeron tanto como los rendimientos nominales del Tesoro, por lo que se aumentó la asignación a TIPS a más largo plazo para aumentar la exposición a los rendimientos reales. La exposición nominal del Fondo a largo plazo del Tesoro se redujo en la caída de

2019, a medida que los rendimientos del Tesoro a largo plazo continuaron disminuyendo. En general, la duración de la cartera fue menor al final del período sobre el que se informa, aunque aún fue más larga en relación con los puntos de referencia del Fondo.

|

|

||

| 2 | Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual |

El Fondo empleó futuros y opciones del Tesoro de EE. UU., Incluidas opciones sobre futuros, Eurodólares

futuros y opciones, futuros del Euro-Bund y opciones sobre futuros del Euro-Bund, durante el período de referencia para gestionar la curva de rendimiento del Fondoviii posicionamiento y riesgo de tasa de interés, y duración. El uso de estos instrumentos, sobre una base absoluta, resta valor a

actuación. Los swaps de tasas de interés, utilizados para gestionar la exposición a las tasas de interés, disminuyeron el rendimiento. Los contratos de swap de incumplimiento crediticio vinculados al crédito, que se emplearon para lograr una exposición sintética a los bonos corporativos, contribuyeron al rendimiento durante

el período del informe

El apalancamiento se utilizó para agregar rendimiento a la cartera, al aumentar la exposición del Fondo a

no TIPS clases de activos, incluidos créditos y productos básicos. El Fondo finalizó el período de presentación de informes con un apalancamiento como porcentaje de los activos brutos de aproximadamente el 31% frente al 30% cuando comenzó el período de presentación de informes. El uso de

el apalancamiento para comprar bonos de productos bursátiles y de mercados emergentes, entre otros, generó resultados positivos durante el período del informe.

Revisión de desempeño

Por los doce meses terminados el 30 de noviembre de 2019,

El Fondo de Oportunidades e Ingresos Vinculados a la Inflación de Activos Occidentales arrojó 10.25% basado en su valor de activo neto

("NAV")ix y 12.53% basado en su Bolsa de Nueva York

("NYSE") precio de mercado por acción. Los puntos de referencia no gestionados del Fondo, el Bloomberg Barclays vinculado a la inflación del gobierno de EE. UU. 1-10 Índice de añoX y el índice Bloomberg Barclays del gobierno de EE. UU. vinculado a la inflación de todos los vencimientosxi, devolvió 6.62% y 9.01%, respectivamente, para el mismo período. Bloomberg Barclays El gobierno mundial relaciona la inflación con todos

Índice de vencimientosXii y el índice de referencia personalizado del Fondoxiii devolvió 8.78% y 9.45%, respectivamente, durante el mismo período de tiempo.

Durante el período de doce meses, el Fondo realizó distribuciones a los accionistas por un total de $ 0,43 por acción *. La tabla de rendimiento muestra el rendimiento total de doce meses del Fondo en función de su VNA y el precio de mercado a partir de

30 de noviembre de 2019. El rendimiento pasado no es garantía de resultados futuros.

| Instantánea de rendimiento al 30 de noviembre de 2019 | ||||

| Precio por acción | 12 meses Regreso trotal** |

|||

| $ 12.74 (NAV) | 10.25 | % † | ||

| $ 11.14 (precio de mercado) | 12,53 | % ‡ | ||

Todas las cifras representan el rendimiento pasado y no son garantía de resultados futuros. Cifras de rendimiento para períodos más cortos que

un año representan cifras acumulativas y no están anualizadas.

** Los rendimientos totales se basan en cambios en el NAV o el precio de mercado, respectivamente. Devoluciones

reflejar la deducción de todos los gastos del Fondo, incluidos los honorarios de administración, los gastos operativos y otros gastos del Fondo. Las devoluciones no reflejan la deducción de las comisiones o impuestos de corretaje que los inversores pueden pagar por las distribuciones o la venta de acciones.

† El rendimiento total supone la reinversión de todas las distribuciones en NAV.

* Para conocer el carácter fiscal de las distribuciones pagadas durante el año fiscal que finalizó el 30 de noviembre de 2019, consulte la página 45 de este

reporte.

|

|

||

| Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual | 3 |

Resumen del fondo (cont.)

‡ El rendimiento total supone la reinversión de todas las distribuciones en adicional

acciones de acuerdo con el Plan de reinversión de dividendos del Fondo.

Una de las características distintivas de

final cerrado Los fondos en comparación con otros vehículos de inversión es la capacidad de comerciar con una prima o descuento para NAV. Dado que el Fondo cotiza en la Bolsa de Nueva York, el precio de la acción puede cotizar por encima (premium) o por debajo

(descuento) su NAV. Mientras que el NAV refleja las inversiones subyacentes del Fondo, el precio de la acción refleja la oferta y la demanda general en el mercado. Históricamente, la mayoría de

final cerrado los fondos se han negociado con un descuento sobre el NAV. Este Fondo no fue una excepción al fenómeno. Creemos que el descuento del Fondo puede estar impulsado por una serie de factores, incluido el total final cerrado mercado de fondos, tasa de distribución actual y demanda silenciada de productos de inversión vinculados a la inflación. Si bien hay acciones que pueden reducir temporalmente el descuento al NAV, que la Junta de Síndicos

Evaluamos regularmente, creemos que si la demanda de los inversores por inversiones vinculadas a la inflación aumentó, ese desarrollo, entre otros factores, puede ayudar a reducir el descuento del precio de las acciones del Fondo a NAV con el tiempo. Western Asset sigue creyendo que

El fondo ofrece a los inversores la oportunidad de protección contra la inflación a largo plazo al tiempo que proporciona una fuente de diversificación para las carteras de renta fija de los inversores.

P. ¿Cuáles fueron los principales contribuyentes al rendimiento?

A. Los mayores contribuyentes a

El rendimiento absoluto del Fondo durante el período sobre el que se informa fueron sus asignaciones a los mercados emergentes en moneda local y deuda denominada en dólares estadounidenses. El Fondo invirtió en mercados emergentes que se correlacionaron con productos básicos que son precursores

a las presiones inflacionarias de EE. UU. En otros lugares, la exposición táctica de los productos básicos del Fondo contribuyó al rendimiento. En particular, el posicionamiento táctico del Fondo en el sector de Energía y metales preciosos fue recompensado.

P. ¿Cuáles fueron los principales detractores del rendimiento?

A. Los detractores del rendimiento absoluto del Fondo fueron relativamente modestos durante el período del informe, con la selección de valores de TIPS y las operaciones con divisas extranjeras en contra de los resultados.

¿Buscando información adicional?

El fondo

se comercializa con el símbolo "WIW" y su precio de mercado de cierre está disponible en la mayoría de los periódicos en las listas de NYSE. El NAV diario está disponible. en línea bajo el símbolo "XWIWX" en la mayoría

sitios web financieros. Barron's y el Wall Street Journal's Lunes edición ambos llevan final cerrado tablas de fondos que proporcionan información adicional. Además, el Fondo emite trimestralmente

comunicado de prensa que se puede encontrar en la mayoría de los principales sitios web financieros, así como en www.lmcef.com (haga clic en el nombre del Fondo).

En un esfuerzo continuo por

proporcionar información sobre el Fondo, los accionistas pueden llamar 1-888-777-0102 (sin cargo), de lunes a viernes de 8:00 a.m.

a las 5:30 p.m. Hora del Este, para el NAV actual del Fondo, el precio de mercado y otra información.

|

|

||

| 4 4 | Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual |

Gracias por su inversión en Western Asset Inflation-Linked Opportunities & Income Fund. Como siempre, nosotros

Apreciamos que nos haya elegido para administrar sus activos y nos mantenemos enfocados en lograr los objetivos de inversión del Fondo.

Sinceramente,

Western Asset Management Company, LLC

20 de diciembre de 2019

RIESGOS Los bonos están sujetos a una variedad de riesgos, incluidos los riesgos de tasa de interés, crédito e inflación. A medida que aumentan las tasas de interés, los precios de los bonos caen, lo que reduce el valor de un ingreso fijo

precio de la inversión. El Fondo está sujeto a los riesgos adicionales asociados con los valores protegidos contra la inflación, incluidos el riesgo de liquidez, el riesgo de prepago, el riesgo de extensión y el riesgo de deflación. Inversiones en empresas extranjeras, incluidas las emergentes.

mercados, implican riesgos más allá de los inherentes únicamente a las inversiones nacionales. El apalancamiento puede hacer que un fondo sea más volátil que si el fondo no hubiera sido apalancado, lo que puede aumentar el riesgo de pérdida de inversión. Derivados, como opciones,

Los futuros, forwards y swaps, pueden ser ilíquidos, crear riesgos de contraparte, aumentar desproporcionadamente las pérdidas y tener un impacto potencialmente grande en el rendimiento de los fondos. En la medida en que el Fondo invierta en activos respaldados, respaldados por hipotecas o

los valores relacionados con hipotecas, su exposición al prepago y los riesgos de extensión pueden ser mayores que si invirtiera en otros valores de renta fija. Las inversiones internacionales están sujetas a fluctuaciones monetarias, así como sociales, económicas y políticas.

riesgos Estos riesgos se magnifican en los mercados emergentes.

Una inversión en el Fondo está sujeta a los siguientes riesgos adicionales. Valores de baja calificación, o valores equivalentes sin calificación, que comúnmente se conocen como

Los “bonos basura” generalmente conllevan una mayor volatilidad potencial de los precios y pueden ser menos líquidos que los valores de mayor calificación. Es posible que el Fondo tenga que aplicar un mayor grado de juicio al establecer un precio para valores de baja calificación para fines

de valoración de acciones de fondos. Los cambios en las condiciones económicas o la evolución con respecto al emisor individual tienen más probabilidades de causar volatilidad de los precios y debilitar la capacidad de dichos valores para realizar pagos de capital e intereses que en el caso de

valores de mayor grado. Se considera que los valores de baja calificación tienen características predominantemente especulativas con respecto a la capacidad del emisor para pagar intereses y pagar el principal. Estos valores también pueden ser más susceptibles a

percibe condiciones adversas de la industria económica y competitiva que los valores de mayor calificación. Los títulos de baja calificación y sin calificación generalmente son emitidos por emisores menos solventes que pueden tener una mayor cantidad de deuda pendiente en relación con sus

activos que los emisores de valores de mayor grado. En caso de quiebra de un emisor, los reclamos de otros acreedores pueden tener prioridad sobre los reclamos de los titulares de valores de menor calificación, dejando pocos o ningún activo disponible para pagar el menor grado

titulares de seguridad. El Fondo puede incurrir en gastos en la medida necesaria para buscar la recuperación en caso de incumplimiento o para negociar nuevos términos con un emisor en mora. Los valores de baja calificación con frecuencia tienen características de rescate que permiten a un emisor recomprar

La garantía del Fondo antes de su vencimiento. Si el emisor canjea valores de baja calificación, el Fondo puede tener que invertir los ingresos en valores con menores

|

|

||

| Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual | 5 5 |

Resumen del fondo (cont.)

cede y puede perder ingresos. Los títulos de baja calificación y sin calificación conllevan el riesgo de que

el administrador de inversiones del Fondo puede no evaluar con precisión la calificación comparativa del valor. El análisis de la solvencia de los emisores de títulos de baja calificación y sin calificación puede ser más complejo que para los emisores de mayor calidad.

valores. En la medida en que el Fondo tenga valores de baja calificación y / o sin calificación, el éxito del Fondo en el logro de sus objetivos de inversión puede depender más del análisis crediticio del administrador de inversiones del Fondo que si el Fondo

poseía valores exclusivamente de mayor calidad y calificación. Si no se producen cambios en los tipos de cambio de divisas como se esperaba, el Fondo puede perder dinero en transacciones de divisas. La capacidad del Fondo de utilizar con éxito las transacciones de divisas depende

en una serie de factores, incluidas las transacciones de divisas disponibles a precios que no son demasiado costosos, la disponibilidad de mercados líquidos y la capacidad del Fondo para predecir con precisión la dirección de los cambios en los tipos de cambio de divisas.

Los tipos de cambio de divisas pueden ser volátiles. Las transacciones de divisas están sujetas al riesgo de contraparte, que es el riesgo de que la otra parte en la transacción no cumpla con su obligación contractual. El Fondo puede ganar exposición a los productos básicos.

mercados invirtiendo una parte de sus activos en una subsidiaria de propiedad absoluta, Western Asset Inflation-Linked Opportunities & Income Fund CFC (la "Subsidiaria"), organizada bajo las leyes de las Islas Caimán. El fondo y el

Las subsidiarias se consideran "grupos de productos básicos" y el asesor de inversiones se considera un "operador de grupo de productos básicos" con respecto al Fondo en virtud de la Ley de Intercambio de Productos Básicos. El asesor de inversiones, directamente oa través de sus afiliados,

por lo tanto, está sujeto a una doble regulación por parte de la Comisión de Bolsa y Valores (la "SEC") y la Comisión de Comercio de Futuros de Productos Básicos (la "CFTC").

Debido a cambios regulatorios recientes, se pueden imponer requisitos regulatorios adicionales y el Fondo puede incurrir en gastos adicionales. Los requisitos reglamentarios que rigen el uso de futuros de productos básicos (que

incluir futuros sobre índices de valores de base amplia, futuros sobre tasas de interés y futuros sobre divisas), las opciones sobre futuros sobre materias primas, ciertos swaps u otras inversiones podrían cambiar en cualquier momento. Inversiones del Fondo en productos vinculados

los derivados pueden someter al Fondo a una mayor volatilidad que las inversiones en valores tradicionales. El valor de los derivados vinculados a materias primas puede verse afectado por cambios en los movimientos generales del mercado, la volatilidad del índice de materias primas, prolongado o intenso.

especulación por parte de los inversores, cambios en las tasas de interés o factores que afectan a una industria o producto en particular, tales como sequías, inundaciones, otros fenómenos climáticos, enfermedades del ganado, embargos, aranceles y políticas internacionales económicas, políticas y regulatorias

desarrollos. Al invertir en la Filial, el Fondo está expuesto indirectamente a los riesgos asociados con las inversiones de la Filial. Las inversiones mantenidas por la Subsidiaria son generalmente similares a las permitidas por el

El Fondo está sujeto a los mismos riesgos que se aplican a inversiones similares si el Fondo lo mantiene directamente. La Subsidiaria no está registrada como una compañía de inversión y no está sujeta a todas las protecciones de los inversionistas de la Ley de Compañía de Inversión de

1940 (la "Ley de 1940"). Los cambios en las leyes de los Estados Unidos y / o las Islas Caimán podrían afectar negativamente al Fondo. Por ejemplo, las Islas Caimán actualmente no imponen ningún impuesto a las ganancias, a las ganancias corporativas o de capital, impuestos sobre bienes,

impuesto de sucesiones, regalo

|

|

||

| 6 6 | Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual |

Impuesto o retención fiscal sobre la Filial. Si la ley de las Islas Caimán cambia de tal manera que la Subsidiaria debe pagar los impuestos de las Islas Caimán, los accionistas probablemente sufrirían una disminución en los retornos de inversión. los

La exposición del Fondo a los mercados de materias primas, incluso a través de la Subsidiaria, puede estar limitada por su intención de calificar como una compañía de inversión regulada para fines del impuesto federal sobre los ingresos de los EE. UU., Y puede interferir con su capacidad para calificar como tal.

Este material no pretende ser una recomendación o un consejo de inversión de ningún tipo, incluso en relación con reinversiones, transferencias y

distribuciones Dicho material no se proporciona en calidad de fiduciario, no se puede confiar en él o en relación con la toma de decisiones de inversión, y no constituye una solicitud de una oferta para comprar o vender valores. Todo el contenido tiene

se ha proporcionado solo con fines informativos o educativos y no pretende ser y no debe interpretarse como asesoramiento legal o fiscal y / o una opinión legal. Siempre consulte a un profesional financiero, fiscal y / o legal con respecto a su

situación.

Las tenencias y los desgloses de la cartera son al 30 de noviembre de 2019 y están sujetos a cambios y pueden no ser representativos de

inversiones actuales o futuras de los gestores de cartera. Consulte las páginas 10 a 20 para obtener una lista y un desglose porcentual de las tenencias del Fondo.

La mención de desgloses sectoriales es solo para fines informativos y

no debe interpretarse como una recomendación para comprar o vender valores. La información proporcionada sobre tales sectores no es una base suficiente sobre la cual tomar una decisión de inversión. Inversores que buscan asesoramiento financiero sobre

La conveniencia de invertir en cualquier valor o estrategia de inversión discutida debe consultar a su profesional financiero. Las cinco principales tenencias del Fondo (como porcentaje de los activos netos) del Fondo al 30 de noviembre de 2019 fueron: Tesoro de EE. UU.

Valores protegidos contra la inflación (108.2%), Bonos corporativos y pagarés (8.7%), No estadounidenses Valores protegidos contra la inflación del Tesoro (8,5%), bonos soberanos (7,2%) y obligaciones hipotecarias garantizadas (6,1%). los

La composición de la cartera del fondo está sujeta a cambios en cualquier momento.

Todas las inversiones están sujetas a riesgos, incluida la posible pérdida de capital. Pasado

El rendimiento no es garantía de resultados futuros. Todo el rendimiento del índice no refleja ninguna deducción por honorarios, gastos o impuestos. Tenga en cuenta que un inversor no puede invertir directamente en un índice.

La información proporcionada no pretende ser un pronóstico de eventos futuros, una garantía de resultados futuros o asesoramiento de inversión. Las opiniones expresadas pueden diferir de las de la empresa en su conjunto.

|

|

||

| Western Anual Inflation-Opportunities & Income Fund 2019 Informe anual | 7 7 |

Resumen del fondo (cont.)

| yo |

"Total de activos gestionados" es igual al total de activos del Fondo (incluidos los activos atribuibles al apalancamiento) menos los pasivos acumulados (que no sean |

| ii |

La duración efectiva es un cálculo de duración para bonos con opciones integradas. La duración efectiva tiene en cuenta que los flujos de efectivo esperados fluctuarán a medida que |

| iii |

Los Valores Protegidos contra la Inflación del Tesoro de los Estados Unidos ("TIPS") son valores indexados a la inflación emitidos por el Tesoro de los Estados Unidos en cinco años, diez años y vencimientos a treinta años. El principal se ajusta al Índice de Precios al Consumidor, la medida de inflación comúnmente utilizada. La tasa de cupón es constante, pero genera una cantidad diferente de interés cuando |

| iv |

La Junta de la Reserva Federal (la "Fed") es responsable de la formulación de políticas de los Estados Unidos diseñadas para promover el crecimiento económico, el pleno empleo, estable |

| v |

El índice de precios al consumidor para todos los consumidores urbanos ("CPI-U") es una medida del cambio promedio en los precios sobre |

| vi |

El índice Bloomberg Barclays de bonos vinculados a la inflación del Tesoro de EE. UU. ("TIPS") representa un índice de mercado no administrado compuesto por el Tesoro de EE. UU. |

| vii |

La duración es la medida de la sensibilidad al precio de un valor de renta fija a un cambio en la tasa de interés de 100 puntos básicos. El cálculo se basa en la ponderación |

| viii |

La curva de rendimiento es la representación gráfica de la relación entre el rendimiento de los bonos de la misma calidad crediticia pero con diferentes vencimientos. |

| ix |

El valor del activo neto (“NAV”) se calcula restando los pasivos totales, incluidos los pasivos asociados con el apalancamiento financiero (si corresponde), del |

| X |

Bloomberg Barclays Vinculado a la inflación del gobierno de EE. UU. 1-10 El índice del año mide el rendimiento del intermedio de EE. UU. |

| xi |

El índice Bloomberg Barclays del gobierno de EE. UU. Vinculado a la inflación de todos los vencimientos mide el rendimiento del mercado de TIPS de EE. UU. El índice incluye TIPS con uno |

| xii |

El índice Bloomberg Barclays del gobierno mundial vinculado a la inflación de todos los vencimientos mide el desempeño de los principales mercados gubernamentales de bonos vinculados a la inflación. |

| xiii |

El índice de referencia personalizado se compone del 90% del índice Bloomberg Barclays del gobierno de EE. UU. Vinculado a la inflación de todos los vencimientos, el 5% del índice de crédito Bloomberg Barclays de EE. UU. Y el 5% |

|

|

||

| 8 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

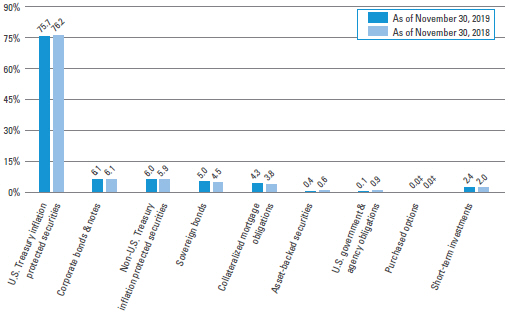

Investment breakdown (%) as a percent of total investments

| † |

The bar graph above represents the composition of the Fund’s investments as of November 30, 2019 and November 30, 2018 and does not |

| ‡ |

Represents less than 0.1%. |

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 9 9 |

Consolidated schedule of investments

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| U.S. Treasury Inflation Protected Securities — 108.2% |

|

|||||||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.375 | % | 1/15/25 | 10,897,120 | PS | 12,089,186 | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.000 | % | 1/15/26 | 145,366,327 | 161,024,302 | (a) | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.375 | % | 1/15/27 | 6,366,000 | 7,335,451 | |||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

1.750 | % | 1/15/28 | 31,865,600 | 35,745,280 | |||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

3.625 | % | 4/15/28 | 15,874,800 | 20,312,767 | (a) | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.500 | % | 1/15/29 | 17,854,787 | 21,515,447 | (a) | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

3.875 | % | 4/15/29 | 74,188,350 | 99,059,218 | (a) | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.125 | % | 2/15/40 | 8,315,510 | 11,017,775 | |||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

2.125 | % | 2/15/41 | 13,366,044 | 17,876,350 | |||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

1.375 | % | 2/15/44 | 55,128,568 | 66,249,163 | (a) | ||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

0.750 | % | 2/15/45 | 27,171,771 | 28,738,171 | |||||||||||

|

U.S. Treasury Bonds, Inflation Indexed |

1.000 | % | 2/15/48 | 3,123,630 | 3,524,431 | |||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/20 | 54,820,500 | 54,667,099 | |||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/21 | 43,333,600 | 43,041,104 | (a) | ||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.625 | % | 7/15/21 | 21,644,990 | 21,792,212 | |||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 1/15/22 | 17,016,300 | 16,915,836 | |||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 4/15/22 | 87,734,487 | 87,096,223 | (a) | ||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 7/15/22 | 64,903,307 | 64,798,561 | (a) | ||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.125 | % | 1/15/23 | 13,748,893 | 13,666,832 | (b) | ||||||||||

|

U.S. Treasury Notes, Inflation Indexed |

0.625 | % | 1/15/26 | 55,390,531 | 56,820,961 | |||||||||||

|

Total U.S. Treasury Inflation Protected Securities (Cost — |

|

843,286,369 | ||||||||||||||

| Corporate Bonds & Notes — 8.7% | ||||||||||||||||

| Energy — 4.9% | ||||||||||||||||

|

Energy Equipment & Services — 0.1% |

||||||||||||||||

|

Halliburton Co., Senior Notes |

3.800 | % | 11/15/25 | 500,000 | 527,459 | |||||||||||

|

Oil, Gas & Consumable Fuels — 4.8% |

||||||||||||||||

|

Apache Corp., Senior Notes |

5.250 | % | 2/1/42 | 910,000 | 906,081 | |||||||||||

|

Apache Corp., Senior Notes |

4.250 | % | 1/15/44 | 2,630,000 | 2,310,355 | |||||||||||

|

Continental Resources Inc., Senior Notes |

4.900 | % | 6/1/44 | 2,250,000 | 2,290,229 | |||||||||||

|

Enterprise Products Operating LLC, Senior Notes |

3.125 | % | 7/31/29 | 3,380,000 | 3,447,487 | |||||||||||

|

Gazprom OAO Via Gaz Capital SA, Senior Notes |

5.150 | % | 2/11/26 | 3,720,000 | 4,110,265 | (c) | ||||||||||

|

KazTransGas JSC, Senior Notes |

4.375 | % | 9/26/27 | 4,000,000 | 4,202,500 | (c) | ||||||||||

|

MEG Energy Corp., Secured Notes |

6.500 | % | 1/15/25 | 30,000 | 31,258 | (c) | ||||||||||

|

MEG Energy Corp., Senior Notes |

7.000 | % | 3/31/24 | 110,000 | 108,144 | (c) | ||||||||||

|

Noble Energy Inc., Senior Notes |

3.900 | % | 11/15/24 | 500,000 | 524,550 | |||||||||||

|

Noble Energy Inc., Senior Notes |

4.950 | % | 8/15/47 | 3,210,000 | 3,426,690 | |||||||||||

See Notes to Consolidated Financial Statements.

|

|

||

| 10 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

|

Oil, Gas & Consumable Fuels — continued |

||||||||||||||||

|

Oasis Petroleum Inc., Senior Notes |

6.875 | % | 3/15/22 | 400,000 | PS | 374,750 | ||||||||||

|

Oasis Petroleum Inc., Senior Notes |

6.875 | % | 1/15/23 | 490,000 | 450,800 | |||||||||||

|

Occidental Petroleum Corp., Senior Notes |

5.550 | % | 3/15/26 | 330,000 | 374,309 | |||||||||||

|

Occidental Petroleum Corp., Senior Notes |

6.200 | % | 3/15/40 | 2,690,000 | 3,201,393 | |||||||||||

|

Petrobras Global Finance BV, Senior Notes |

5.999 | % | 1/27/28 | 3,690,000 | 4,118,640 | |||||||||||

|

Range Resources Corp., Senior Notes |

5.000 | % | 3/15/23 | 900,000 | 784,116 | |||||||||||

|

Whiting Petroleum Corp., Senior Notes |

5.750 | % | 3/15/21 | 1,860,000 | 1,706,085 | |||||||||||

|

Whiting Petroleum Corp., Senior Notes |

6.250 | % | 4/1/23 | 1,100,000 | 767,250 | |||||||||||

|

Williams Cos. Inc., Senior Notes |

5.750 | % | 6/24/44 | 2,350,000 | 2,697,126 | |||||||||||

|

YPF SA, Senior Notes |

8.500 | % | 7/28/25 | 1,700,000 | 1,403,206 | (d) | ||||||||||

|

Total Oil, Gas & Consumable Fuels |

37,235,234 | |||||||||||||||

|

Total Energy |

37,762,693 | |||||||||||||||

| Financials — 1.0% | ||||||||||||||||

|

Banks — 0.7% |

||||||||||||||||

|

Barclays Bank PLC, Subordinated Notes |

7.625 | % | 11/21/22 | 5,060,000 | 5,678,408 | |||||||||||

|

Diversified Financial Services — 0.2% |

||||||||||||||||

|

ILFC E-Capital Trust II, Ltd. GTD ((Highest of 3 mo. USD LIBOR, 10 year Treasury |

4.020 | % | 12/21/65 | 2,084,000 | 1,632,678 |

(c)(e) |

||||||||||

|

Insurance — 0.1% |

||||||||||||||||

|

Ambac Assurance Corp., Subordinated Notes |

5.100 | % | 6/7/20 | 48,493 | 71,182 | (c) | ||||||||||

|

Ambac LSNI LLC, Senior Secured Notes (3 mo. USD LIBOR + 5.000%) |

7.104 | % | 2/12/23 | 206,853 | 208,920 | (c)(e) | ||||||||||

|

Total Insurance |

280,102 | |||||||||||||||

|

Total Financials |

7,591,188 | |||||||||||||||

| Health Care — 1.2% | ||||||||||||||||

|

Health Care Equipment & Supplies — 0.1% |

||||||||||||||||

|

Immucor Inc., Senior Notes |

11.125 | % | 2/15/22 | 1,180,000 | 1,184,793 |

(c) |

||||||||||

|

Pharmaceuticals — 1.1% |

||||||||||||||||

|

Bausch Health Americas Inc., Senior Notes |

9.250 | % | 4/1/26 | 2,870,000 | 3,292,565 | (c) | ||||||||||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 11 |

Consolidated schedule of investments (cont’d)

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

|

Pharmaceuticals — continued |

||||||||||||||||

|

Bausch Health Americas Inc., Senior Notes |

8.500 | % | 1/31/27 | 1,970,000 | PS | 2,235,999 | (c) | |||||||||

|

Bausch Health Cos. Inc., Senior Notes |

9.000 | % | 12/15/25 | 2,620,000 | 2,960,600 | (c) | ||||||||||

|

Total Pharmaceuticals |

8,489,164 | |||||||||||||||

|

Total Health Care |

9,673,957 | |||||||||||||||

| Materials — 1.6% | ||||||||||||||||

|

Metals & Mining — 1.6% |

||||||||||||||||

|

Alcoa Nederland Holding BV, Senior Notes |

6.125 | % | 5/15/28 | 1,470,000 | 1,587,339 | (c) | ||||||||||

|

Anglo American Capital PLC, Senior Notes |

4.000 | % | 9/11/27 | 1,630,000 | 1,697,492 | (c) | ||||||||||

|

ArcelorMittal, Senior Notes |

6.125 | % | 6/1/25 | 720,000 | 816,920 | |||||||||||

|

Glencore Funding LLC, Senior Notes |

4.125 | % | 3/12/24 | 750,000 | 787,535 | (c) | ||||||||||

|

Glencore Funding LLC, Senior Notes |

4.000 | % | 3/27/27 | 500,000 | 518,581 | (c) | ||||||||||

|

Glencore Funding LLC, Senior Notes |

3.875 | % | 10/27/27 | 1,630,000 | 1,691,484 | (c) | ||||||||||

|

Southern Copper Corp., Senior Notes |

5.250 | % | 11/8/42 | 3,440,000 | 3,885,298 | |||||||||||

|

Yamana Gold Inc., Senior Notes |

4.625 | % | 12/15/27 | 1,360,000 | 1,440,605 | |||||||||||

|

Total Materials |

12,425,254 | |||||||||||||||

|

Total Corporate Bonds & Notes (Cost — $63,505,333) |

|

67,453,092 | ||||||||||||||

| Non-U.S. Treasury Inflation Protected Securities — 8.5% |

|

|||||||||||||||

|

Brazil — 3.1% |

||||||||||||||||

|

Brazil Notas do Tesouro Nacional Serie B, Notes |

6.000 | % | 8/15/30 | 26,794,787 | BRL | 7,970,193 | ||||||||||

|

Brazil Notas do Tesouro Nacional Serie B, Notes |

6.000 | % | 8/15/50 | 47,093,869 | BRL | 16,008,349 | ||||||||||

|

Total Brazil |

23,978,542 | |||||||||||||||

|

Italy — 4.1% |

||||||||||||||||

|

Italy Buoni Poliennali Del Tesoro |

3.100 | % | 9/15/26 | 24,206,945 | EUR | 31,958,387 |

(d) |

|||||||||

|

Russia — 0.5% |

||||||||||||||||

|

Russian Federal Inflation Linked Bond — OFZ |

2.500 | % | 2/2/28 | 267,397,500 | RUB | 3,987,606 | ||||||||||

|

Uruguay — 0.8% |

||||||||||||||||

|

Uruguay Government International Bond |

4.250 | % | 4/5/27 | 230,403,318 | UYU | 6,428,970 | ||||||||||

|

Total Non-U.S. Treasury Inflation Protected |

|

66,353,505 | ||||||||||||||

| Sovereign Bonds — 7.2% | ||||||||||||||||

|

Argentina — 0.2% |

||||||||||||||||

|

Argentina POM Politica Monetaria, Bonds (Argentina Central Bank 7 Day Repo Reference Rate) |

70.941 | % | 6/21/20 | 276,920,000 | ARS | 1,202,638 |

(e)(f) |

|||||||||

See Notes to Consolidated Financial Statements.

|

|

||

| 12 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

|

Brazil — 0.1% |

||||||||||||||||

|

Brazil Notas do Tesouro Nacional Serie F, Notes |

10.000 | % | 1/1/21 | 1,900,000 | BRL | PS | 472,582 | |||||||||

|

Brazil Notas do Tesouro Nacional Serie F, Notes |

10.000 | % | 1/1/27 | 570,000 | BRL | 157,659 | ||||||||||

|

Total Brazil |

630,241 | |||||||||||||||

|

Chile — 0.9% |

||||||||||||||||

|

Bonos de la Tesoreria de la Republica en pesos, Bonds |

5.000 | % | 3/1/35 | 4,785,000,000 | CLP | 6,923,734 | ||||||||||

|

Ecuador — 0.5% |

||||||||||||||||

|

Ecuador Government International Bond, Senior Notes |

10.500 | % | 3/24/20 | 3,120,000 | 3,087,059 | (c) | ||||||||||

|

Ecuador Government International Bond, Senior Notes |

7.950 | % | 6/20/24 | 1,070,000 | 881,857 | (d) | ||||||||||

|

Total Ecuador |

3,968,916 | |||||||||||||||

|

Indonesia — 1.7% |

||||||||||||||||

|

Indonesia Government International Bond, Senior Notes |

3.850 | % | 7/18/27 | 400,000 | 424,481 | (c) | ||||||||||

|

Indonesia Government International Bond, Senior Notes |

3.500 | % | 1/11/28 | 1,790,000 | 1,860,572 | |||||||||||

|

Indonesia Government International Bond, Senior Notes |

5.125 | % | 1/15/45 | 430,000 | 510,482 | (c) | ||||||||||

|

Indonesia Government International Bond, Senior Notes |

4.750 | % | 7/18/47 | 880,000 | 1,010,888 | (c) | ||||||||||

|

Indonesia Government International Bond, Senior Notes |

4.350 | % | 1/11/48 | 2,010,000 | 2,211,795 | |||||||||||

|

Indonesia Treasury Bond, Senior Notes |

7.000 | % | 5/15/27 | 100,812,000,000 | IDR | 7,177,914 | ||||||||||

|

Total Indonesia |

13,196,132 | |||||||||||||||

|

Mexico — 2.8% |

||||||||||||||||

|

Mexican Bonos, Bonds |

8.000 | % | 11/7/47 | 51,280,000 | MXN | 2,825,199 | ||||||||||

|

Mexican Bonos, Senior Notes |

7.750 | % | 11/13/42 | 273,450,000 | MXN | 14,597,331 | ||||||||||

|

Mexico Government International Bond, Senior Notes |

4.500 | % | 4/22/29 | 3,720,000 | 4,082,700 | |||||||||||

|

Total Mexico |

21,505,230 | |||||||||||||||

|

Nigeria — 0.0% |

||||||||||||||||

|

Nigeria Government International Bond, Senior Notes |

6.500 | % | 11/28/27 | 280,000 | 280,185 |

(c) | ||||||||||

|

Qatar — 0.5% |

||||||||||||||||

|

Qatar Government International Bond, Senior Notes |

4.000 | % | 3/14/29 | 3,770,000 | 4,206,566 |

(c) |

||||||||||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 13 |

Consolidated schedule of investments (cont’d)

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

|

Russia — 0.5% |

||||||||||||||||

|

Russian Federal Bond — OFZ |

7.050 | % | 1/19/28 | 250,000,000 | RUB | PS | 4,082,608 | |||||||||

|

Total Sovereign Bonds (Cost — $66,063,782) |

|

55,996,250 | ||||||||||||||

| Collateralized Mortgage Obligations (g) — 6.1% |

|

|||||||||||||||

|

Banc of America Funding Trust, 2015-R2 4A2 (1 mo. USD LIBOR + |

3.251 | % | 9/29/36 | 13,420,848 | 11,648,370 | (c)(e) | ||||||||||

|

Banc of America Funding Trust, 2015-R2 5A2 |

3.501 | % | 9/29/36 | 8,427,565 | 6,755,673 | (c)(e) | ||||||||||

|

Credit Suisse Commercial Mortgage Trust, 2006-C5 AJ |

5.373 | % | 12/15/39 | 1,288,902 | 858,808 | |||||||||||

|

Credit Suisse Commercial Mortgage Trust, 2007-C5 AM |

5.869 | % | 9/15/40 | 1,210,207 | 774,533 | (e) | ||||||||||

|

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust, |

4.000 | % | 8/25/56 | 3,690,000 | 3,738,741 | (c)(e) | ||||||||||

|

Federal Home Loan Mortgage Corp. (FHLMC) Seasoned Credit Risk Transfer Trust Series, |

4.000 | % | 8/25/56 | 5,170,000 | 5,157,796 | (c)(e) | ||||||||||

|

Federal Home Loan Mortgage Corp. (FHLMC) Structured Agency Credit Risk Debt Notes, 2017-DNA2 M2 (1 mo. USD LIBOR + |

5.158 | % | 10/25/29 | 2,660,000 | 2,835,861 | (e) | ||||||||||

|

Federal National Mortgage Association (FNMA) — CAS, 2017-C06 1B1 (1 mo. USD |

5.858 | % | 2/25/30 | 2,950,000 | 3,190,192 | (c)(e) | ||||||||||

|

Federal National Mortgage Association (FNMA) — CAS, 2019-R07 1M2 (1 mo. USD |

3.808 | % | 10/25/39 | 2,860,000 | 2,877,374 | (c)(e) | ||||||||||

|

JPMorgan Chase Commercial Mortgage Securities Trust, 2007-CB19 AJ |

6.006 | % | 2/12/49 | 2,256,717 | 1,469,971 | (e) | ||||||||||

|

JPMorgan Chase Commercial Mortgage Securities Trust, 2007-LD12 AJ |

6.650 | % | 2/15/51 | 43,260 | 41,308 | (e) | ||||||||||

|

Lehman Mortgage Trust, 2006-5 2A2, IO |

5.442 | % | 9/25/36 | 2,759,530 | 787,205 | (e) | ||||||||||

|

Morgan Stanley Mortgage Loan Trust, 2007-11AR 2A3 |

3.504 | % | 6/25/37 | 89,156 | 67,535 | (e) |

||||||||||

See Notes to Consolidated Financial Statements.

|

|

||

| 14 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Collateralized Mortgage Obligations (g) — continued |

|

|||||||||||||||

|

Natixis Commercial Mortgage Securities Trust, 2019-TRUE A (1 mo. USD LIBOR + 2.011%) |

3.773 | % | 4/18/24 | 5,700,000 | PS | 5,714,045 | (c)(e) | |||||||||

|

WaMu Mortgage Pass-Through Certificates Trust, 2006-AR3 A1B (Federal Reserve |

3.326 | % | 2/25/46 | 2,009,975 | 1,945,777 | (e) | ||||||||||

|

Total Collateralized Mortgage Obligations (Cost — $42,576,088) |

|

47,863,189 | ||||||||||||||

| Asset-Backed Securities — 0.6% | ||||||||||||||||

|

Bear Stearns Asset Backed Securities Trust, 2007-SD2 2A1 (1 mo. USD LIBOR + |

2.108 | % | 9/25/46 | 46,441 | 44,674 | (e) | ||||||||||

|

Origen Manufactured Housing Contract Trust, 2007-B A1 (1 mo. USD LIBOR + |

2.965 | % | 10/15/37 | 4,947,977 | 4,887,225 | (c)(e) | ||||||||||

|

Security National Mortgage Loan Trust, 2006-3A A2 |

5.830 | % | 1/25/37 | 73,612 | 73,801 | (c)(e) | ||||||||||

|

Total Asset-Backed Securities (Cost — $4,576,956) |

|

5,005,700 | ||||||||||||||

| U.S. Government & Agency Obligations — 0.1% |

|

|||||||||||||||

|

U.S. Government Obligations — 0.1% |

||||||||||||||||

|

U.S. Treasury Bonds (Cost — $869,743) |

2.375 | % | 11/15/49 | 880,000 | 913,619 | |||||||||||

| Expiration Date |

Contracts | Notional Amount† |

||||||||||||||

| Purchased Options — 0.0% | ||||||||||||||||

| Exchange-Traded Purchased Options — 0.0% |

|

|||||||||||||||

|

U.S. Treasury 10-Year Notes Futures, Call @ $129.50 |

12/27/19 | 335 | 335,000 | 167,500 | ||||||||||||

|

U.S. Treasury Long-Term Bonds Futures, Call @ $159.00 |

12/27/19 | 67 | 67,000 | 85,844 | ||||||||||||

|

Total Purchased Options (Cost — $248,258) |

|

253,344 | ||||||||||||||

|

Total Investments before Short-Term Investments (Cost — |

|

1,087,125,068 | ||||||||||||||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 15 |

Consolidated schedule of investments (cont’d)

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

| Seguridad | Rate | Maturity Date |

Face Amount† |

Value | ||||||||||||

| Short-Term Investments — 3.4% | ||||||||||||||||

| Repurchase Agreements — 0.8% | ||||||||||||||||

|

Deutsche Bank AG, repurchase agreement dated 11/29/19, Proceeds at Maturity — $6,000,800; (Fully collateralized by |

1.600 | % | 12/2/19 | 6,000,000 | PS | 6,000,000 | ||||||||||

| Sovereign Bonds — 0.2% | ||||||||||||||||

|

Argentina Treasury Bills (Cost — $5,736,577) |

40.684 | % | 7/29/20 | 154,500,000 | ARS | 1,652,665 |

(f)(h) |

|||||||||

| Shares | ||||||||||||||||

| Money Market Funds — 2.4% | ||||||||||||||||

|

Dreyfus Government Cash Management, Institutional Shares (Cost — $18,550,389) |

1.556 | % | 18,550,389 | 18,550,389 | ||||||||||||

|

Total Short-Term Investments (Cost — $30,286,966) |

|

26,203,054 | ||||||||||||||

|

Total Investments — 142.8% (Cost — $1,082,687,402) |

|

1,113,328,122 | ||||||||||||||

|

Liabilities in Excess of Other Assets — (42.8)% |

|

(333,807,755 | ) | |||||||||||||

|

Total Net Assets — 100.0% |

PS | 779,520,367 | ||||||||||||||

| † |

Face amount/notional amount denominated in U.S. dollars, unless otherwise noted. |

| (a) |

All or a portion of this security is held by the counterparty as collateral for open reverse repurchase agreements. |

| (b) |

All or a portion of this security is held at the broker as collateral for open futures contracts. |

| (c) |

Security is exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions that are exempt from |

| (d) |

Security is exempt from registration under Regulation S of the Securities Act of 1933. Regulation S applies to securities offerings that are made outside of the |

| (e) |

Variable rate security. Interest rate disclosed is as of the most recent information available. Certain variable rate securities are not based on a published |

| (f) |

Security is valued in good faith in accordance with procedures approved by the Board of Trustees (Note 1). |

| (g) |

Collateralized mortgage obligations are secured by an underlying pool of mortgages or mortgage pass-through certificates that are structured to direct payments |

| (h) |

Rate shown represents yield-to-maturity. |

See Notes to Consolidated Financial Statements.

|

|

||

| 16 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Western Asset Inflation-Linked Opportunities & Income Fund

|

Abbreviations used in this schedule: |

||

| ARS | — Argentine Peso | |

| BRL | — Brazilian Real | |

| CAS | — Connecticut Avenue Securities | |

| CLP | — Chilean Peso | |

| CMT | — Constant Maturity Treasury | |

| EUR | — Euro | |

| GTD | — Guaranteed | |

| IDR | — Indonesian Rupiah | |

| IO | — Interest Only | |

| JSC | — Joint Stock Company | |

| LIBOR | — London Interbank Offered Rate | |

| MXN | — Mexican Peso | |

| RUB | — Russian Ruble | |

| USD | — United States Dollar | |

| UYU | — Uruguayan Peso | |

At November 30, 2019, the Fund had the following open reverse repurchase agreements:

| Counterparty | Rate | Effective Date |

Maturity Date |

Face Amount of Reverse Repurchase Agreements |

Asset Class of Collateral* | Collateral Value |

||||||||||||||||

| Credit Suisse | 2.600% | 4/8/2019 | TBD** | PS | 20,137,500 | U.S. Treasury Inflation Protected Securities | PS | 21,494,745 | ||||||||||||||

| Morgan Stanley & Co. Inc. | 2.050% | 10/8/2019 | 12/13/2019 | 338,825,000 | U.S. Treasury Inflation Protected Securities | 333,227,255 | ||||||||||||||||

| Efectivo | 9,556,000 | |||||||||||||||||||||

| PS | 358,962,500 | PS | 364,278,000 | |||||||||||||||||||

| * * |

Refer to the Consolidated Schedule of Investments for positions held at the counterparty as collateral for reverse repurchase agreements. |

| ** ** |

TBD—To Be Determined; These reverse repurchase agreements have no maturity dates because they are renewed daily and can be terminated by either the |

| Schedule of Written Options | ||||||||||||||||||||

| Exchange-Traded Written Options |

|

|||||||||||||||||||

| Seguridad | Expiration Date |

Strike Precio |

Contracts | Notional Amount |

Value | |||||||||||||||

| U.S. Treasury 10-Year Notes Futures, Call | 12/27/19 | PS | 131.00 | 669 | PS | 669,000 | PS | (73,172) | ||||||||||||

| U.S. Treasury 10-Year Notes Futures, Call | 2/21/20 | 131.00 | 335 | 335,000 | (146,563) | |||||||||||||||

| U.S. Treasury Long-Term Bonds Futures, Call | 12/27/19 | 158.00 | 268 | 268,000 | (489,938) | |||||||||||||||

| U.S. Treasury Long-Term Bonds Futures, Call | 12/27/19 | 160.00 | 134 | 134,000 | (115,156) | |||||||||||||||

| U.S. Treasury Long-Term Bonds Futures, Call | 12/27/19 | 161.00 | 134 | 134,000 | (73,281) | |||||||||||||||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 17 |

Consolidated schedule of investments (cont’d)

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

| Schedule of Written Options (cont’d) | ||||||||||||||||||||

| Seguridad | Expiration Date |

Strike Precio |

Contracts | Notional Amount |

Value | |||||||||||||||

| U.S. Treasury Long-Term Bonds Futures, Call | 2/21/20 | PS | 160.00 | 167 | PS | 167,000 | PS | (307,906) | ||||||||||||

| U.S. Treasury Long-Term Bonds Futures, Call | 2/21/20 | 161.00 | 836 | 836,000 | (1,227,875) | |||||||||||||||

| Total Exchange-Traded Written Options (Premiums received — $2,256,898) |

|

PS | (2,433,891) | |||||||||||||||||

At November 30, 2019, the Fund had the following open futures contracts:

| Number of Contracts |

Expiration Date |

Notional Amount |

Mercado Value |

Unrealized Appreciation (Depreciation) |

||||||||||||||||

| Contracts to Buy: | ||||||||||||||||||||

| 90-Day Eurodollar | 190 | 19/12 | PS | 46,195,067 | PS | 46,593,938 | PS | 398,871 | ||||||||||||

| 90-Day Eurodollar | 1,340 | 6/20 | 329,249,189 | 329,573,000 | 323,811 | |||||||||||||||

| 90-Day Eurodollar | 78 | 3/21 | 19,187,189 | 19,215,300 | 28,111 | |||||||||||||||

| Copper | 338 | 3/20 | 22,756,695 | 22,489,675 | (267,020) | |||||||||||||||

| Euro | 94 | 19/12 | 13,074,422 | 12,956,725 | (117,697) | |||||||||||||||

| Gold 100 Ounce | 114 | 4/20 | 17,159,565 | 16,850,340 | (309,225) | |||||||||||||||

| Mexican Peso | 86 | 19/12 | 2,172,390 | 2,193,860 | 21,470 | |||||||||||||||

| Plata | 102 | 3/20 | 9,183,825 | 8,724,060 | (459,765) | |||||||||||||||

| U.S. Treasury 2-Year Notes | 618 | 3/20 | 133,358,564 | 133,232,110 | (126,454) | |||||||||||||||

| U.S. Treasury 5-Year Notes | 578 | 3/20 | 68,808,216 | 68,763,938 | (44,278) | |||||||||||||||

| U.S. Treasury 10-Year Notes | 749 | 3/20 | 96,986,267 | 96,890,175 | (96,092) | |||||||||||||||

| U.S. Treasury Long-Term Bonds | 19 | 3/20 | 3,039,151 | 3,020,406 | (18,745) | |||||||||||||||

| WTI Crude | 283 | 12/20 | 14,907,503 | 14,803,730 | (103,773) | |||||||||||||||

| (770,786) | ||||||||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| British Pound | 67 | 19/12 | 5,182,283 | 5,417,369 | (235,086) | |||||||||||||||

| Euro-Bund | 231 | 19/12 | 44,836,163 | 43,536,066 | 1,300,097 | |||||||||||||||

| Gasolina | 38 | 3/20 | 2,503,625 | 2,560,144 | (56,519) | |||||||||||||||

| U.S. Treasury Ultra Long-Term Bonds | 346 | 3/20 | 65,243,370 | 64,950,687 | 292,683 | |||||||||||||||

| 1,301,175 | ||||||||||||||||||||

| Net unrealized appreciation on open futures contracts |

|

PS | 530,389 | |||||||||||||||||

See Notes to

Consolidated Financial Statements.

|

|

||

| 18 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Western Asset Inflation-Linked Opportunities & Income Fund

At November 30, 2019, the Fund had the following open forward foreign currency contracts:

| Moneda Purchased |

Moneda Sold |

Counterparty | Asentamiento Date |

Unrealized Appreciation (Depreciation) |

||||||||||||||||

| COP | 82,621,685,652 | USD | 23,544,644 | Barclays Bank PLC | 1/17/20 | PS | (118,672) | |||||||||||||

| IDR | 52,969,535,174 | USD | 3,677,929 | Barclays Bank PLC | 1/17/20 | 59,060 | ||||||||||||||

| INR | 1,036,321,925 | USD | 14,466,193 | Barclays Bank PLC | 1/17/20 | (84,641) | ||||||||||||||

| JPY | 897,550,000 | USD | 8,443,794 | Barclays Bank PLC | 1/17/20 | (212,333) | ||||||||||||||

| MYR | 49,281,000 | USD | 11,727,987 | Barclays Bank PLC | 1/17/20 | 60,935 | ||||||||||||||

| USD | 17,945,032 | EUR | 16,200,000 | Barclays Bank PLC | 1/17/20 | 31,448 | ||||||||||||||

| USD | 5,624,567 | MXN | 112,802,368 | Barclays Bank PLC | 1/17/20 | (104,392) | ||||||||||||||

| USD | 8,662,270 | EUR | 7,837,846 | BNP Paribas SA | 1/17/20 | (4,638) | ||||||||||||||

| BRL | 25,359,699 | USD | 6,054,787 | Citibank N.A. | 1/17/20 | (85,846) | ||||||||||||||

| BRL | 30,058,681 | USD | 7,054,372 | Citibank N.A. | 1/17/20 | 20,573 | ||||||||||||||

| BRL | 30,650,000 | USD | 7,330,432 | Citibank N.A. | 1/17/20 | (116,307) | ||||||||||||||

| EUR | 200,000 | USD | 223,844 | Citibank N.A. | 1/17/20 | (2,689) | ||||||||||||||

| EUR | 300,000 | USD | 331,738 | Citibank N.A. | 1/17/20 | (5) | ||||||||||||||

| GBP | 4,241,448 | USD | 5,202,709 | Citibank N.A. | 1/17/20 | 293,726 | ||||||||||||||

| RUB | 2,101,159,580 | USD | 32,366,862 | Citibank N.A. | 1/17/20 | 70,809 | ||||||||||||||

| USD | 468,107 | AUD | 696,486 | Citibank N.A. | 1/17/20 | (3,634) | ||||||||||||||

| USD | 18,858,986 | EUR | 17,090,000 | Citibank N.A. | 1/17/20 | (38,739) | ||||||||||||||

| USD | 16,236,445 | TWD | 499,498,000 | JPMorgan Chase & Co. | 1/17/20 | (172,306) | ||||||||||||||

| Total |

|

PS | (407,651) | |||||||||||||||||

|

Abbreviations used in this table: |

||

| AUD | — Australian Dollar | |

| BRL | — Brazilian Real | |

| COP | — Colombian Peso | |

| EUR | — Euro | |

| GBP | — British Pound | |

| IDR | — Indonesian Rupiah | |

| INR | — Indian Rupee | |

| JPY | — Japanese Yen | |

| MXN | — Mexican Peso | |

| MYR | — Malaysian Ringgit | |

| RUB | — Russian Ruble | |

| TWD | — Taiwan Dollar | |

| USD | — United States Dollar | |

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 19 |

Consolidated schedule of investments (cont’d)

November 30, 2019

Western Asset Inflation-Linked Opportunities & Income Fund

At November 30, 2019, the Fund had the following open swap contracts:

| CENTRALLY CLEARED INTEREST RATE SWAPS | ||||||||||||||

| Notional Amount |

Termination Date |

Pagos Made by the Fund† |

Pagos Received by the Fund† |

Upfront Premiums Paid (Received) |

Unrealized (Depreciation) |

|||||||||

| $39,783,000 | 8/31/23 | 2.500% semi-annually | 3-Month LIBOR quarterly | $(2,481) | $(1,341,511) | |||||||||

| OTC INTEREST RATE SWAPS | ||||||||||||||||||||||

| Swap Counterparty | Notional Amount |

Termination Date |

Pagos Made by the Fund† |

Pagos Received by the Fund† |

Upfront Premiums Paid (Received) |

Unrealized Appreciation |

||||||||||||||||

| Barclays Bank PLC | PS | 95,600,000 | 5/3/20 | 2.023%* | CPURNSA | * * | – | PS | 126,597 | |||||||||||||

| CENTRALLY CLEARED CREDIT DEFAULT SWAPS ON CREDIT INDICES — SELL PROTECTION1 | ||||||||||||||||||||||

| Referencia Entity |

Notional Amount2 |

Termination Date |

Periodic Pagos Received by the Fund† |

Mercado Value3 |

Upfront Premiums Paid (Received) |

Unrealized Appreciation |

||||||||||||||||

| Markit CDX.NA.IG.33 Index | PS | 42,285,000 | 12/20/24 | 1.000% quarterly | PS | 1,018,603 | PS | 811,412 | PS | 207,191 | ||||||||||||

| 1 |

If the Fund is a seller of protection and a credit event occurs, as defined under the terms of that particular swap agreement, the Fund will either (i) pay |

| 2 |

The maximum potential amount the Fund could be required to pay as a seller of credit protection or receive as a buyer of credit protection if a credit event |

| 3 |

The quoted market prices and resulting values for credit default swap agreements on asset-backed securities and credit indices serve as an indicator of the |

| † |

Percentage shown is an annual percentage rate. |

| * * |

One time payment made at termination date. |

|

Abbreviations used in this table: |

||

| CPURNSA | — U.S. CPI Urban Consumers NSA Index | |

| LIBOR | — London Interbank Offered Rate | |

See Notes to

Consolidated Financial Statements.

|

|

||

| 20 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Consolidated statement of assets and liabilities

November 30, 2019

| Assets: | ||||

|

Investments, at value (Cost — $1,082,687,402) |

PS | 1,113,328,122 | ||

|

Foreign currency, at value (Cost — $4,618,243) |

4,563,283 | |||

|

Efectivo |

45,921 | |||

|

Receivable for securities sold |

17,686,515 | |||

|

Deposits with brokers for reverse repurchase agreements |

9,559,000 | |||

|

Deposits with brokers for open futures contracts and exchange-traded options |

8,502,976 | |||

|

Interest receivable |

6,126,215 | |||

|

Deposits with brokers for centrally cleared swap contracts |

991,209 | |||

|

Foreign currency collateral for open futures contracts and exchange-traded options, at value (Cost — |

739,149 | |||

|

Unrealized appreciation on forward foreign currency contracts |

536,551 | |||

|

Deposits with brokers for OTC derivatives |

270,000 | |||

|

OTC swaps, at value (premiums paid — $0) |

126,597 | |||

|

Prepaid expenses |

24,919 | |||

|

Total Assets |

1,162,500,457 | |||

| Liabilities: | ||||

|

Payable for open reverse repurchase agreements (Note 3) |

358,962,500 | |||

|

Payable for securities purchased |

17,887,526 | |||

|

Written options, at value (premiums received — $2,256,898) |

2,433,891 | |||

|

Interest payable |

1,386,543 | |||

|

Unrealized depreciation on forward foreign currency contracts |

944,202 | |||

|

Payable to broker — variation margin on open futures contracts |

379,479 | |||

|

Deposits from brokers for open reverse repurchase agreements |

366,000 | |||

|

Investment management fee payable |

328,756 | |||

|

Administration fee payable |

46,965 | |||

|

Trustees’ fees payable |

27,887 | |||

|

Payable to broker — variation margin on centrally cleared swap contracts |

12,708 | |||

|

Accrued expenses |

203,633 | |||

|

Total Liabilities |

382,980,090 | |||

| Total Net Assets | PS | 779,520,367 | ||

| Net Assets: | ||||

|

Common shares, no par value, unlimited number of shares authorized, 61,184,134 shares issued and |

PS | 819,718,608 | ||

|

Total distributable earnings (loss) |

(40,198,241) | |||

| Total Net Assets | PS | 779,520,367 | ||

| Shares Outstanding | 61,184,134 | |||

| Net Asset Value | PS | 12.74 | ||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 21 |

Consolidated statement of operations

For the Year Ended November 30, 2019

| Investment Income: | ||||

|

Interest |

PS | 37,707,043 | ||

|

Less: Foreign taxes withheld |

(118,057) | |||

|

Total Investment Income |

37,588,986 | |||

| Expenses: | ||||

|

Interest expense (Note 3) |

8,589,211 | |||

|

Investment management fee (Note 2) |

3,867,616 | |||

|

Administration fees (Note 2) |

552,517 | |||

|

Legal fees |

371,105 | |||

|

Trustees’ fees |

186,557 | |||

|

Transfer agent fees |

95,878 | |||

|

Fund accounting fees |

82,426 | |||

|

Custody fees |

65,985 | |||

|

Audit and tax fees |

55,239 | |||

|

Commodity pool reports |

42,935 | |||

|

Stock exchange listing fees |

33,754 | |||

|

Seguro |

13,417 | |||

|

Shareholder reports |

3,598 | |||

|

Miscellaneous expenses |

15,744 | |||

|

Total Expenses |

13,975,982 | |||

| Net Investment Income | 23,613,004 | |||

| Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Written Options, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4): |

||||

|

Net Realized Gain (Loss) From: |

||||

|

Investment transactions |

(2,238,163) | |||

|

Futures contracts |

(13,406,472) | |||

|

Written options |

1,643,978 | |||

|

Swap contracts |

611,549 | |||

|

Forward foreign currency contracts |

2,789,225 | |||

|

Foreign currency transactions |

(729,215) | |||

|

Net Realized Loss |

(11,329,098) | |||

|

Change in Net Unrealized Appreciation (Depreciation) From: |

||||

|

Inversiones |

58,946,485 | |||

|

Futures contracts |

3,208,220 | |||

|

Written options |

(176,993) | |||

|

Swap contracts |

(798,763) | |||

|

Forward foreign currency contracts |

1,021,739 | |||

|

Foreign currencies |

(96,921) | |||

|

Change in Net Unrealized Appreciation (Depreciation) |

62,103,767 | |||

| Net Gain on Investments, Futures Contracts, Written Options, Swap Contracts, Forward Foreign Currency Contracts and Foreign Currency Transactions |

50,774,669 | |||

| Increase in Net Assets From Operations | PS | 74,387,673 | ||

See Notes to

Consolidated Financial Statements.

|

|

||

| 22 | Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report |

Consolidated statements of changes in net assets

| For the Years Ended November 30, | 2019 | 2018 | ||||||

| Operations: | ||||||||

|

Net investment income |

PS | 23,613,004 | PS | 25,716,139 | ||||

|

Net realized gain (loss) |

(11,329,098) | 649,223 | ||||||

|

Change in net unrealized appreciation (depreciation) |

62,103,767 | (50,782,002) | ||||||

|

Increase (Decrease) in Net Assets From Operations |

74,387,673 | (24,416,640) | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

|

Total distributable earnings |

(26,431,546) | (26,431,546) | ||||||

|

Decrease in Net Assets From Distributions to |

(26,431,546) | (26,431,546) | ||||||

|

Increase (Decrease) in Net Assets |

47,956,127 | (50,848,186) | ||||||

| Net Assets: | ||||||||

|

Beginning of year |

731,564,240 | 782,412,426 | ||||||

|

End of year |

PS | 779,520,367 | PS | 731,564,240 | ||||

See Notes to

Consolidated Financial Statements.

|

|

||

| Western Asset Inflation-Linked Opportunities & Income Fund 2019 Annual Report | 23 |

Consolidated statement of cash flows

For the Year Ended November 30, 2019

| Increase (Decrease) in Cash: | ||||

| Cash Provided (Used) by Operating Activities: | ||||

|

Net increase in net assets resulting from operations |

PS | 74,387,673 | ||

|

Adjustments to reconcile net increase in net assets resulting from operations to net cash provided (used) by operating |

||||

|

Purchases of portfolio securities |

(371,127,786) | |||

|

Sales of portfolio securities |

381,220,427 | |||

|

Net purchases, sales and maturities of short-term investments |

(11,159,821) | |||

|

Net inflation adjustment |

(14,593,707) | |||

|

Net amortization of premium (accretion of discount) |

1,922,588 | |||

|

Increase in receivable for securities sold |

(9,880,248) | |||

|

Increase in interest receivable |

(215,690) | |||

|

Decrease in prepaid expenses |

2,336 | |||

|

Decrease in payable to broker — variation margin on centrally cleared swap contracts |

(5,051) | |||

|

Increase in deposits from brokers for reverse repurchase agreements |

366,000 | |||

|

Increase in payable for securities purchased |

7,012,431 | |||

|

Increase in investment management fee payable |

27,144 | |||

|

Decrease in Trustees’ fees payable |

(268) | |||

|

Increase in administration fee payable |

3,878 | |||

|

Increase in interest payable |

859,180 | |||

|

Decrease in accrued expenses |

(52,449) | |||

|

Increase in premiums received from written options |

2,256,898 | |||

|

Increase in payable to broker — variation margin on open futures contracts |

274,327 | |||

|

Net realized loss on investments |

2,238,163 | |||

|

Change in net unrealized appreciation (depreciation) of investments, written options, |

||||

|

OTC swap contracts and forward foreign currency contracts |

(59,917,828) | |||

|

Net Cash Provided by Operating Activities* |

3,618,197 | |||

| Cash Flows From Financing Activities: | ||||

|

Distributions paid on common stock |

(26,431,546) | |||

|

Increase in payable for reverse repurchase agreements |

35,867,375 | |||

|

Net Cash Provided in Financing Activities |

9,435,829 | |||

| Net Increase in Cash and Restricted Cash | 13,054,026 | |||

|

Cash and restricted cash at beginning of year |

11,617,512 | |||

|

Cash and restricted cash at end of year |

PS | 24,671,538 | ||

| * * |

Included in operating expenses is cash of $7,730,031 paid for interest on borrowings. |

|

The following table provides a reconciliation of cash and restricted cash reported within the Consolidated Statement of Assets and Liabilities that sums |

| November 30, 2019 | ||||

| Efectivo | PS | 4,609,204 | ||

| Restricted cash | 20,062,334 | |||

| Total cash and restricted cash shown in the Consolidated Statement of Cash Flows | PS | 24,671,538 | ||

|

Restricted cash consists of cash that has been segregated to cover the Fund’s collateral or margin obligations under derivative contracts. Es |

See Notes to Consolidated Financial Statements.

|

|

||