Entra en Wall Street con StreetInsider Premium. Reclama tu prueba gratuita de 1 semana aquí.

La información en este preliminar

El suplemento de precios no está completo y puede modificarse. Este suplemento de precio preliminar no es una oferta para vender estos valores.

y no solicita una oferta para comprar estos valores en ninguna jurisdicción donde la oferta o venta no esté permitida.

Sujeto a finalización fechado

16 de diciembre de 2019.

|

Diciembre 2019 |

| Suplemento de precios preliminares No. A332 | |

| Declaración de registro No. 333-218604-02 | |

| Fechado el 16 de diciembre de 2019 | |

| Archivado de conformidad con la Regla 424 (b) (2) |

INVERSIONES ESTRUCTURADAS

MÁS Basado en el valor de una cesta ponderada

Compuesto por Seven Basket Components con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Los valores son obligaciones no garantizadas de Credit Suisse, will

no paga intereses y no garantiza ninguna devolución del capital al vencimiento. Al vencimiento, si la Cesta tiene apreciado en

valor, los inversores recibirán el monto principal de su inversión más el rendimiento alcista apalancado de la canasta, sujeto

al pago máximo al vencimiento. Sin embargo, si la cesta tiene depreciado en valor, los inversores perderán 1% por cada 1%

disminución en el nivel de la cesta desde el nivel de cesta inicial hasta el nivel de cesta final. En estas circunstancias, el pago

al vencimiento será menor que el monto principal y podría ser cero. En consecuencia, puede perder toda su inversión.

Los valores son para inversores que buscan un rendimiento basado en componentes de capital y que están dispuestos a arriesgar su capital y renunciar

ingresos actuales y al alza por encima del pago máximo al vencimiento a cambio de la función de apalancamiento, que se aplica por un período limitado

gama de rendimiento al alza de la cesta. Los inversores pueden perder toda su inversión en los valores..

Todos los pagos de los valores, incluido el reembolso de

principal, están sujetos al riesgo de crédito de Credit Suisse.

| TÉRMINOS CLAVE | ||||

| Editor: | Credit Suisse AG ("Credit Suisse"), actuando a través de su sucursal en Londres. | |||

| Cesta: | Componente de cesta | Corazón | Nivel de componente inicial | Ponderación de componentes |

| S&P 500® Índice de valor | SVX |

25/100 | ||

| Vectores VanEck® Mineros de oro ETF | GDX UP |

15/100 | ||

| EURO STOXX® Índice de bancos | SX7E |

15/100 | ||

| iShares® ETF de mercados emergentes de MSCI | EEM UP |

15/100 | ||

| SPDR® S&P® ETF de exploración y producción de petróleo y gas | XOP UP |

10/100 | ||

| Índice de precios de acciones de Tokio | TPX |

10/100 | ||

| Materiales Seleccionar Sector SPDR® Financiar | XLB UP |

10/100 | ||

| Para obtener más información sobre los componentes de la cesta, consulte "Los componentes de la cesta" en este documento. | ||||

| Cantidad principal agregada: | PS | |||

| Cantidad principal: | $ 10 por seguridad. Los valores se ofrecen con una inversión mínima de 100 valores a $ 10 por valor (lo que representa una inversión de $ 1,000), y múltiplos integrales de $ 10 en exceso. | |||

| Precio al público: | $ 10 por valor (ver "Comisiones y precio al público" a continuación) | |||

| Pago al vencimiento: | Si el nivel final de la canasta es mas grande que el Nivel de cesta inicial, el menor de (i) el Pago máximo al vencimiento y (ii) un monto calculado de la siguiente manera: | |||

| $ 10 + pago al revés apalancado | ||||

| En ningún caso el pago al vencimiento excederá el pago máximo al vencimiento. | ||||

| Si el nivel final de la canasta es Menos que o igual a el nivel de cesta inicial, una cantidad calculada de la siguiente manera: | ||||

| $ 10 × Factor de rendimiento de la cesta | ||||

| En estas circunstancias, el pago al vencimiento será menor o igual al monto principal de $ 10. | ||||

| Pago al revés apalancado: | $ 10 × Factor de apalancamiento × Aumento del porcentaje de la cesta | |||

| Listado: | Los valores no se incluirán en ninguna bolsa de valores. | |||

| Términos clave continúa en la página siguiente | ||||

Invertir en los valores implica una serie de riesgos.

Consulte "Consideraciones de riesgo seleccionadas" que comienzan en la página 7 de este suplemento de precios y "Factores de riesgo"

comenzando en la página PS-3 de cualquier suplemento de producto que lo acompañe.

Ni la Comisión de Bolsa y Valores ni ningún estado

la comisión de valores ha aprobado o desaprobado los valores o ha pasado la exactitud o la idoneidad de este precio

suplemento o el suplemento subyacente que lo acompaña, cualquier suplemento de producto, el suplemento de prospecto y el prospecto. Ninguna

La representación en contrario es un delito penal.

| Comisiones y Precio al Público | Precio al público | Descuentos y comisiones de suscripción | Ingresos al Emisor |

| Por seguridad | $ 10 | $ 0.125(1) | |

| $ 0.05(2) | $ 9.825 | ||

| Total | PS | PS | PS |

(1) Nosotros o uno de nuestros afiliados podemos pagarle a Morgan Stanley Smith

Barney LLC ("MSSB") descuentos y comisiones variables de hasta $ 0.175 por cada monto de capital de $ 10, de los cuales

Se pagarán $ 0.05 por cada monto principal de $ 10 de valores como una tarifa de estructuración. Para obtener información más detallada, consulte "Suplementario

Plan de distribución (conflictos de intereses) "en este suplemento de precios.

(2) Refleja una tarifa de estructura pagadera a MSSB por Credit Suisse

Securities (USA) LLC ("CSSU") o una de sus filiales de $ 0.05 por cada valor.

El agente de esta oferta, CSSU, es nuestro afiliado. Para más

información, consulte "Plan de distribución suplementario (conflictos de intereses)" en este suplemento de precios.

Credit Suisse actualmente estima el valor de cada capital de $ 10

El monto de los valores en la Fecha de Negociación estará entre $ 9.575 y $ 9.825 (según lo determinado por referencia a nuestros modelos de precios

y la tasa que estamos pagando actualmente por préstamos de fondos mediante la emisión de los valores (nuestra "tasa de financiación interna").

Este rango de valores estimados refleja términos que aún no están fijos. Se determinará un único valor estimado que refleje los términos finales.

en la fecha de negociación. Consulte "Consideraciones de riesgo seleccionadas" en este suplemento de precios.

Los valores no son pasivos de depósito y no están asegurados.

o garantizado por la Federal Deposit Insurance Corporation o cualquier otra agencia gubernamental de los Estados Unidos, Suiza o

cualquier otra jurisdicción

Credit Suisse

Basado en PLUS

sobre el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

| Términos clave de la página anterior: |

|

Nivel de canasta final: inicial Nivel de cesta inicial |

|

Factor de rendimiento de la cesta:

|

|

Nivel de canasta final Nivel de cesta inicial |

| Nivel de componente inicial: | Para cada Componente de la cesta, el nivel de cierre de dicho Componente de la cesta en la Fecha de negociación. En el caso de que el nivel de cierre para cualquier Componente de la Cesta no esté disponible en la Fecha de Negociación, el Nivel de Componente Inicial para dicho Componente de la Cesta se determinará el día de negociación inmediatamente siguiente en el que esté disponible un nivel de cierre. |

| Nivel de componente final: | Para cada Componente de la cesta, el nivel de cierre de dicho Componente de la cesta en la Fecha de valoración |

| Devolución del componente de la cesta: | Para cada componente de la cesta, el nivel de componente final dividido por El nivel de componente inicial. El “Retorno del componente SVX” es el retorno del componente de la cesta para el S&P 500® Índice de valor. "Retorno de componente GDX" es el retorno de componente de cesta para los vectores VanEck® Mineros de oro ETF. "Retorno de componentes SX7E" es el retorno de componentes de la cesta para EURO STOXX® Índice de bancos. "Retorno de componentes EEM" es el retorno de componentes de la cesta para los iShares® MSCI Emerging Markets ETF. "Retorno de componentes XOP" es el retorno de componentes de la cesta para el SPDR® S&P® Exploración y producción de petróleo y gas ETF. El “Retorno del componente TPX” es el Retorno del componente de la cesta para el Índice de precios de acciones de Tokio. El "Retorno de componentes XLB" es el Retorno de componentes de la cesta para el Sector de selección de materiales SPDR® Financiar. |

| Nivel de cesta inicial: | Establecer igual a 100 en la fecha de negociación. |

| Nivel de canasta final: | 100 x ((Retorno del componente SVX x Ponderación del componente SVX) + (Retorno del componente GDX x Ponderación del componente GDX) + (Retorno del componente SX7E x Ponderación del componente SX7E) + (Retorno del componente EEM x Ponderación del componente EEM) + (Retorno del componente XOP x Componente XOP Ponderación) + (retorno del componente TPX x ponderación del componente TPX) + (retorno del componente XLB x ponderación del componente XLB)) |

| Factor de apalancamiento: | 200% |

| Pago máximo al vencimiento: | Se espera que sea $ 10.79 por valor (107.90% del monto del principal y se determinará en la Fecha de Negociación). |

| Fecha comercial: | Se espera que sea aproximadamente el 30 de diciembre de 2019 |

| Fecha de liquidación: | Se espera que sea aproximadamente el 3 de enero de 2020 (3 días hábiles después de la Fecha de negociación). La entrega de los valores en forma de anotaciones en cuenta solo se realizará a través de The Depository Trust Company. |

| Fecha de la valoración: | 30 de junio de 2020, sujeto a aplazamiento como se establece en cualquier suplemento del producto adjunto en "Descripción de los valores: aplazamiento de las fechas de cálculo". |

| Fecha de vencimiento: | 6 de julio de 2020, sujeto a aplazamiento como se establece en cualquier suplemento del producto adjunto en "Descripción de los valores: aplazamiento de las fechas de cálculo". Si la fecha de vencimiento no es un día hábil, el pago al vencimiento se pagará el primer día siguiente día hábil, a menos que ese día hábil caiga en el siguiente mes calendario, en cuyo caso el pago se realizará el primer día hábil anterior. |

| CUSIP / ISIN: | 22550K780 / US22550K7809 |

| Distribuidor: | MSSB. Ver "Plan Suplementario de Distribución". |

| Agente de cálculo: | Credit Suisse International |

Puede revocar su oferta de compra de valores en cualquier momento

tiempo anterior al momento en que aceptamos dicha oferta en la fecha en que se cotizan los valores. Nos reservamos el derecho de cambiar el

términos de, o rechazar cualquier oferta para comprar los valores antes de su emisión. En caso de cualquier cambio en los términos de la

valores, le notificaremos y se le pedirá que acepte dichos cambios en relación con su compra. También puedes elegir

para rechazar dichos cambios, en cuyo caso podemos rechazar su oferta de compra.

Basado en PLUS

sobre el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Términos adicionales específicos de los valores

Debe leer este suplemento de precios junto con el subyacente

suplemento del 19 de abril de 2018, los suplementos del producto del 30 de junio de 2017, el suplemento del folleto del 30 de junio de 2017 y

el folleto con fecha del 30 de junio de 2017, en relación con nuestras Notas a mediano plazo de las cuales forman parte estos valores. Puedes acceder a estos

documentos en el sitio web de la SEC en www.sec.gov de la siguiente manera (o si dicha dirección ha cambiado, revisando nuestras presentaciones para la información relevante

fecha en el sitio web de la SEC):

| • | Suplemento subyacente de fecha 19 de abril de 2018: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010318004962/dp89590_424b2-underlying.htm

| • | Suplemento del producto No. I – B del 30 de junio de 2017: |

http://www.sec.gov/Archives/edgar/data/1053092/000095010317006316/dp77781_424b2-ib.htm

| • | Suplemento de producto No. I-C del 30 de junio de 2017: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010317006317/dp77785_424b2-ic.htm

| • | Folleto Suplemento y Folleto de 30 de junio de 2017: |

http://www.sec.gov/Archives/edgar/data/1053092/000104746917004364/a2232566z424b2.htm

En el caso de los términos de los valores descritos en este precio

el suplemento difiere o es inconsistente con los términos descritos en el suplemento subyacente, cualquier suplemento de producto, el

prospecto o prospecto, controlarán los términos descritos en este suplemento de precios.

Nuestra clave de índice central, o CIK, en el sitio web de la SEC es 1053092.

Tal como se utiliza en este suplemento de precios, "nosotros", "nos" o "nuestro" se refiere a Credit Suisse.

Este suplemento de precios, junto con los documentos enumerados anteriormente,

contiene los términos de los valores y reemplaza todas las demás declaraciones orales anteriores o contemporáneas, así como cualquier otra declaración escrita

materiales que incluyen términos de precios preliminares o indicativos, hojas informativas, correspondencia, ideas comerciales, estructuras para la implementación,

Estructuras de muestra, folletos u otros materiales educativos nuestros. Podemos, sin el consentimiento del titular registrado de la

valores y el propietario de cualquier interés beneficioso en los valores, modifique los valores para cumplir con los términos establecidos

en este suplemento de precios y los documentos enumerados anteriormente, y el síndico está autorizado a realizar dicha modificación sin

cualquier consentimiento de este tipo. Debe considerar cuidadosamente, entre otras cosas, los asuntos establecidos en "Consideraciones de riesgo seleccionadas"

en este suplemento de precios y "Factores de riesgo" en cualquier suplemento de producto que lo acompañe, "Riesgos de moneda extranjera"

en el prospecto adjunto, y cualquier factor de riesgo que describimos en el Informe Anual combinado en el Formulario 20-F del Grupo Credit Suisse

AG y nosotros incorporamos por referencia, y cualquier factor de riesgo adicional que describamos en futuras presentaciones que hagamos ante la SEC

bajo la Ley de Bolsa de Valores de 1934, según enmendada, ya que los valores implican riesgos no asociados con los valores de deuda convencionales.

Debe consultar a sus asesores de inversiones, legales, fiscales, contables y de otro tipo antes de decidir invertir en los valores.

Prohibición de ventas a inversores minoristas del EEE

Los valores no se pueden ofrecer, vender o poner a disposición de otra manera

a cualquier inversor minorista en el Espacio Económico Europeo. A los fines de esta disposición:

(a) la expresión "inversor minorista" significa una persona

quién es uno (o más) de los siguientes:

(i) un cliente minorista tal como se define en el punto (11)

del artículo 4, apartado 1, de la Directiva 2014/65 / UE (en su versión modificada, "MiFID II"); o

(ii) un cliente en el sentido de la Directiva 2002/92 / CE,

donde ese cliente no calificaría como cliente profesional como se define en el punto (10) del Artículo 4 (1) de MiFID II; o

(iii) no es un inversor calificado como se define

en la Directiva 2003/71 / CE; y

(b) la expresión "oferta" incluye la comunicación

en cualquier forma y por cualquier medio de información suficiente sobre los términos de la oferta y los valores ofrecidos para permitir un

inversor para decidir comprar o suscribir los valores.

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Resumen de inversiones

Rendimiento de valores alcistas

Valores principales en riesgo

El PLUS basado en el valor de una cesta ponderada que consiste en

Se pueden usar Seven Basket Components con vencimiento el 6 de julio de 2020:

| § | Como alternativa a la exposición directa a los componentes de la cesta que mejora los rendimientos para un cierto rango de rendimiento positivo de los componentes de la cesta, sujetos al pago máximo al vencimiento. |

| § | Para mejorar los rendimientos y potencialmente superar a los Componentes de la cesta en un escenario moderadamente alcista. |

| § | Para lograr niveles similares de exposición al alza a los Componentes de la cesta como inversión directa, sujeto al Pago máximo al vencimiento, mientras usa menos dólares aprovechando el factor de apalancamiento. |

Los valores están expuestos 1: 1 a la rentabilidad negativa.

de la canasta.

| Madurez: | Aproximadamente 6 meses. |

| Factor de apalancamiento: | 200% (aplicable solo si el nivel de cesta final es mayor que el nivel de cesta inicial). |

| Pago Máximo al Vencimiento: | Se espera que sea $ 10.79 por valor (107.90% del monto del principal y se determinará en la Fecha de Negociación). |

| Pago mínimo al vencimiento: | Ninguna. Los inversores pueden perder toda su inversión inicial en los valores. |

| Cupón: | Ninguna. |

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Fundamento clave de inversión

La oferta de valores tiene una exposición apalancada a un cierto rango de

Rendimiento positivo de una cesta ponderada que consta de siete componentes de cesta. A cambio de un rendimiento mejorado del 200% de

Con la apreciación de la canasta, los inversores renuncian al rendimiento por encima del pago máximo al vencimiento, que se espera sea de $ 10.79

por seguridad (se determinará en la Fecha de Negociación). Al vencimiento, si la cesta se ha apreciado en valor, los inversores recibirán

el monto principal de su inversión más el rendimiento alcista apalancado de la canasta, sujeto al pago máximo al vencimiento.

Sin embargo, si la cesta se ha depreciado en valor, los inversores perderán un 1% por cada disminución del 1% en el nivel de la cesta desde

Nivel de cesta inicial al nivel de cesta final. En estas circunstancias, el pago al vencimiento será menor que el principal

cantidad y podría ser cero. Los inversores pueden perder toda su inversión inicial en los valores. Todos los pagos de los valores.

están sujetos al riesgo de crédito de Credit Suisse.

| Rendimiento apalancado | Los valores ofrecen a los inversores la oportunidad de capturar rendimientos mejorados en relación con una inversión directa en los Componentes de la cesta dentro de un cierto rango de rendimiento positivo. |

| Escenario al revés | El valor de la canasta aumenta y, al vencimiento, usted recibe un retorno total del capital, así como el 200% del aumento en el valor de la canasta, sujeto al pago máximo al vencimiento, que se espera que sea de $ 10.79 por valor ( 107.90% del monto principal y se determinará en la Fecha de Negociación). Por ejemplo, si el Nivel de cesta final es un 3% mayor que el Nivel de cesta inicial, los valores proporcionarán un rendimiento total del 6% al vencimiento. |

| Escenario par | El nivel de cesta final es igual al nivel de cesta inicial. En este caso, recibirá el monto principal de $ 10 al vencimiento. |

| Escenario negativo | El valor de la canasta disminuye y, al vencimiento, los valores se canjean por menos del monto principal en una cantidad proporcional a la disminución en el valor de la canasta desde el nivel de canasta inicial hasta el nivel de canasta final. Por ejemplo, si el Nivel de canasta final es un 30% menor que el Nivel de canasta inicial, los valores se canjearán al vencimiento por una pérdida del 30% del capital a $ 7, o el 70% del monto del capital. No existe un Pago mínimo al vencimiento de los valores, y podría perder toda su inversión. |

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Cómo funcionan los valores

Los números que aparecen en las secciones a continuación se han redondeado.

para facilitar el análisis.

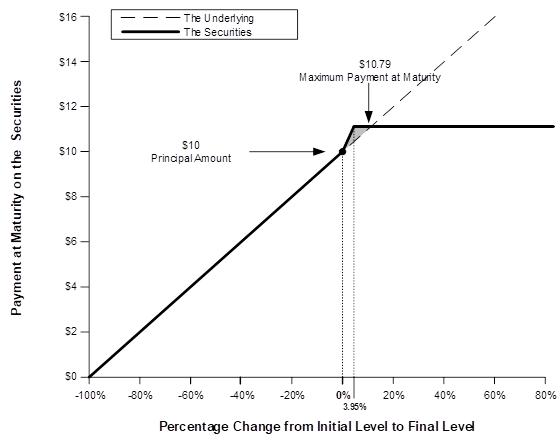

Diagrama de pago

El diagrama de pagos a continuación ilustra el pago al vencimiento

en los valores basados en los siguientes términos:

| Cantidad principal: | $ 10 por seguridad |

| Factor de apalancamiento: | 200% |

| Pago Máximo al Vencimiento: | Se espera que sea $ 10.79 por valor (107.90% del monto del principal y se determinará en la Fecha de Negociación) |

| Pago mínimo al vencimiento: | Ninguna |

| Diagrama de pago de valores |

|

Vea la siguiente página para una descripción

de cómo funcionan los valores.

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Cómo funciona

| § | Escenario al revés. Si el nivel de canasta final es mayor que el nivel de canasta inicial, el inversionista recibiría el monto principal de $ 10 más el 200% de la apreciación de la canasta desde el nivel de canasta inicial hasta el nivel de canasta final, sujeto al pago máximo al vencimiento. Según los términos de los valores, un inversor se dará cuenta el pago máximo al vencimiento en un nivel de canasta final de aproximadamente 103.95% del nivel de canasta inicial. |

| § | Si la canasta se aprecia un 2%, el inversor recibiría un rendimiento del 4%, o $ 10.40 por valor. |

| § | Si la canasta se aprecia un 40%, el inversor recibiría solo el pago máximo al vencimiento de $ 10.79 por valor, o 107.90% del monto principal. |

| § | Par Scenario. Si el nivel de cesta final es igual al nivel de cesta inicial, el el inversionista recibiría el monto principal de $ 10 |

| § | Escenario negativo. Si el nivel de cesta final es inferior al nivel de cesta inicial, el inversor recibiría un monto menor al monto de capital de $ 10, basado en una pérdida de capital del 1% por cada disminución del 1% en la cesta. En estas circunstancias, el pago al vencimiento será inferior al monto principal por valor. Ahi esta sin pago mínimo al vencimiento de los valores. |

| § | Si la canasta se deprecia 30%, el inversionista perdería el 30% del capital del inversor y recibiría solo $ 7 por valor al vencimiento, o el 70% del monto principal. |

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

Consideraciones de riesgo seleccionadas

Esta sección describe los riesgos más significativos relacionados

a los valores. Para obtener una lista completa de los factores de riesgo, consulte el suplemento, el prospecto y el prospecto del producto adjunto.

suplemento. Los inversores deben consultar a sus asesores financieros y legales sobre los riesgos que conlleva una inversión en los valores.

y la idoneidad de los valores a la luz de sus circunstancias particulares.

| § | La inversión en los valores puede resultar en una pérdida. Los valores no garantizan la devolución de su capital. cantidad. Podría perder hasta $ 10 por cada monto principal de $ 10 de valores. Si el nivel de canasta final es menor que la canasta inicial Nivel, perderá el 1% de su capital por cada disminución del 1% en el nivel de la canasta desde el nivel de canasta inicial hasta el final Nivel de cesta. Cualquier pago de los valores está sujeto a nuestra capacidad de pagar nuestras obligaciones a medida que vencen. |

| § | Independientemente del monto de cualquier pago que reciba por los valores, su rendimiento real puede ser diferente en valor real condiciones. La inflación puede hacer que el valor real de cualquier pago que reciba de los valores sea menor al vencimiento de lo que es el tiempo que inviertes. Una inversión en los valores también representa una oportunidad perdida para invertir en un activo alternativo que genera un mayor rendimiento real Debe considerar detenidamente si una inversión que puede generar un rendimiento inferior a El rendimiento de las inversiones alternativas es apropiado para usted. |

| § | Potencial de apreciación limitado. Si el nivel de canasta final es mayor que el nivel de canasta inicial, por cada capital de $ 10 cantidad de valores, tendrá derecho a recibir al vencimiento el menor de (i) el Pago Máximo al Vencimiento y (ii) el suma de $ 10 y el pago al revés apalancado, que será igual al producto de (a) $ 10, (b) el factor de apalancamiento y (c) el porcentaje cambio de la canasta del nivel de canasta inicial al nivel de canasta final. El pago al vencimiento no excederá el máximo Pago al vencimiento, independientemente de la apreciación en el nivel de la canasta, que puede ser significativa. |

| § | Los cambios en los niveles de los componentes de la cesta pueden compensarse entre sí. Movimientos en los niveles de los componentes de la cesta pueden no correlacionarse entre sí. En un momento en que el nivel de uno de los componentes de la cesta aumenta, el nivel de la otra cesta Los componentes pueden no aumentar tanto o incluso disminuir. Por lo tanto, al calcular el nivel de cesta final, un aumento en el nivel uno de los Componentes de la canasta puede ser moderado, o más que compensado, por un aumento o disminución menor en el nivel del otro Componentes de la cesta. Porque el S&P 500® El índice de valor tiene una mayor ponderación que los otros componentes de la cesta, una disminución en el S&P 500® El índice de valor tendrá un efecto desproporcionadamente adverso sobre el valor de la canasta y puede conducir a un bajo rendimiento incluso si los otros componentes de la cesta funcionan favorablemente. |

| § | Los componentes de la cesta no tienen la misma ponderación. Los valores están vinculados a una cesta de siete Componentes de la cesta, y los componentes de la cesta tienen pesos significativamente diferentes para determinar el valor de la cesta. El mismo porcentaje Por lo tanto, el cambio en cualquiera de los siete Componentes de la canasta podría tener diferentes efectos en el Nivel de canasta final debido a ponderación desigual Por ejemplo, si la ponderación de un componente de cesta es mayor que la ponderación de otra cesta Componente, una disminución del 5% desde el nivel de componente inicial hasta el nivel de componente final del componente de la cesta con el una mayor ponderación tendrá un mayor impacto en el Nivel de cesta final que un aumento del 5% desde el Nivel de componente inicial hasta El nivel de componente final del componente de cesta con la menor ponderación. |

| § | Los valores están sujetos al riesgo de crédito de Credit Suisse. Los inversores dependen de nuestra capacidad para pagar todas las cantidades. debido a los valores y, por lo tanto, si no cumpliéramos con nuestras obligaciones, es posible que no reciba ninguna cantidad que se le adeuda bajo los valores Además, cualquier disminución en nuestras calificaciones crediticias, cualquier cambio adverso en la visión del mercado de nuestra solvencia o cualquier aumento en nuestros diferenciales de crédito puede afectar negativamente el valor de los valores antes del vencimiento. |

| § | Los valores no pagan intereses. No pagaremos intereses sobre los valores. Puede recibir menos al vencimiento que podría haberse ganado con títulos de deuda ordinarios que devengan intereses con vencimientos similares, incluidos otros de nuestros títulos de deuda, ya que el Pago al vencimiento al vencimiento se basa en el desempeño de la Cesta. Porque el pago al vencimiento al vencimiento puede ser inferior a la cantidad invertida originalmente en los valores, el rendimiento de los valores (el |

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

rendimiento efectivo hasta el vencimiento) puede

ser negativo Incluso si es positivo, la rentabilidad pagadera de cada valor puede no ser suficiente para compensarle por cualquier pérdida de valor.

debido a la inflación y otros factores relacionados con el valor del dinero a lo largo del tiempo.

| § | La probabilidad de que el nivel de cesta final sea menor que el nivel de cesta inicial dependerá de la volatilidad de Los componentes de la cesta. La "volatilidad" se refiere a la frecuencia y magnitud de los cambios en los niveles de la canasta. Componentes. Cuanto mayor sea la volatilidad esperada con respecto a los Componentes de la Cesta en la Fecha de Negociación, mayor será la expectativa A partir de la fecha de negociación, el nivel de canasta final podría ser menor que el nivel de canasta inicial, lo que indica un mayor riesgo esperado de pérdida en los valores. Los términos de los valores se establecen, en parte, en función de las expectativas sobre la volatilidad de la canasta. Componentes a la fecha de negociación. La volatilidad de los componentes de la cesta puede cambiar significativamente durante el plazo de los valores. Los niveles de los componentes de la cesta podrían caer bruscamente, lo que podría provocar una pérdida significativa de capital. Deberías estar dispuesto aceptar el riesgo de mercado a la baja de los Componentes de la cesta y el potencial de perder una cantidad significativa de su capital en madurez. |

| § | La estrategia de inversión representada por el S&P 500® El índice de valor puede no ser exitoso – Los S&P 500® Value Index está diseñado para medir el rendimiento total de las empresas incluidas en el S&P 500® Índice que exhibe características de valor relativamente fuertes (determinado por referencia a (1) relación valor-libro-precio, (2) ganancias-precio relación y (3) relación ventas-precio) y características de crecimiento relativamente débiles (determinadas por referencia al crecimiento de las ganancias por acción, crecimiento de las ventas por acción y el impulso al alza del precio de las acciones) y una parte del desempeño de las empresas con un valor más equilibrado y características de crecimiento (donde se asigna mayor peso a las empresas con características de valor relativamente más fuertes y relativamente características de crecimiento más débiles). Sin embargo, no hay garantía de que el S&P 500® El índice de valor superará cualquier otro índice o estrategia que rastree las acciones estadounidenses seleccionadas usando otros criterios. Una estrategia de inversión de "valor" es bajo el objetivo de invertir en acciones que se determinan que son relativamente baratas o "infravaloradas" bajo el supuesto que el valor de esas acciones aumentará con el tiempo a medida que el mercado llegue a reflejar el valor de mercado "justo" de esas cepo. Sin embargo, las características de valor a las que hace referencia el S&P 500® El índice de valor puede no ser predictores precisos de las existencias infravaloradas, y no hay garantía de que las existencias infravaloradas se aprecien. Además, el S&P 500® La metodología de selección de Value Index incluye un sesgo en contra de acciones con fuertes características de crecimiento y acciones con fuertes Las características de crecimiento pueden superar a las existencias con características de crecimiento débiles. Es posible que la metodología de selección de valores del S&P 500® El índice de valor afectará negativamente su rendimiento y, en consecuencia, el nivel del S&P 500® Índice de valor y el valor de sus valores. |

| § | El nivel de cierre del EURO STOXX® El índice de bancos y el índice de precios de acciones de Tokio no se ajustarán para cambios en los tipos de cambio en relación con el dólar estadounidense a pesar de que los valores de renta variable incluidos en el EURO STOXX® El índice de bancos y el índice de precios de acciones de Tokio se negocian en monedas extranjeras y los valores están denominados en dólares estadounidenses. El valor de sus valores no se ajustará a las fluctuaciones del tipo de cambio entre el dólar estadounidense y las monedas en que los valores de renta variable incluidos en el EURO STOXX® Se basan el índice de bancos y el índice de precios de acciones de Tokio. Por lo tanto, Si las monedas aplicables se aprecian o deprecian en relación con el dólar estadounidense durante el plazo de los valores, no recibir cualquier pago adicional o incurrir en una reducción en su devolución, si corresponde, al vencimiento. |

| § | Riesgo de mercados de valores extranjeros. Algunos o todos los activos incluidos en el VanEck Vectores® Mineros de oro ETF, EURO STOXX® Índice de bancos, índice de precios de acciones de Tokio y iShares® Los ETF de mercados emergentes de MSCI son emitidos por compañías extranjeras y operan en mercados de valores extranjeros. Por lo tanto, las inversiones en valores implican riesgos asociados con los mercados de valores en esos países, incluidos los riesgos. de volatilidad en esos mercados, intervención gubernamental en esos mercados y participaciones cruzadas en compañías de ciertos países. Además, las compañías extranjeras generalmente están sujetas a normas y requisitos contables, de auditoría e informes financieros y valores. reglas comerciales diferentes a las aplicables a las compañías de informes de EE. UU. Los valores de renta variable incluidos en el VanEck Vectores® Mineros de oro ETF, EURO STOXX® Índice de bancos, índice de precios de acciones de Tokio y iShares® El ETF de mercados emergentes de MSCI puede ser más volátil que los valores de renta variable nacional y puede estar sujeto a diferentes riesgos políticos, de mercado, económicos, cambiarios, regulatorios y de otro tipo, incluidos los cambios en gobiernos extranjeros, políticas económicas y fiscales, leyes de cambio de divisas u otras leyes o restricciones. Además, las economías de países extranjeros. puede diferir favorable o desfavorablemente de la economía de los Estados Unidos en aspectos tales como el crecimiento del producto nacional bruto, tasa de inflación, reinversión de capital, recursos y autosuficiencia. Estos factores pueden afectar negativamente los valores del patrimonio valores incluidos en el |

MÁS Basado en el valor de una canasta ponderada que consta de siete componentes de canasta con vencimiento el 6 de julio de 2020

Rendimiento de valores alcistasSM

Valores principales en riesgo

VanEck

Vectores® Mineros de oro ETF, EURO STOXX® Índice de bancos, índice de precios de acciones de Tokio y

iShares® ETF de mercados emergentes de MSCI y, por lo tanto, el rendimiento de dichos componentes de cesta y el valor

de los valores.

| § | Las acciones incluidas en los Vectores VanEck® Gold Miners ETF, EURO STOXX® Índice de bancos, SPDR® S&P® ETF de exploración y producción de petróleo y gas y Materiales Seleccionar Sector SPDR® Financiar son concentrado en un sector particular. Todas las acciones incluidas en el Vectores VanEck® Mineros de oro ETF, EURO STOXX® Bancos, SPDR® S&P® Índice ETF de exploración y producción de petróleo y gas y Materiales Seleccionar Sector SPDR® Fund are issued by companies in a single sector. As a result, the stocks that will determine the performance of the VanEck Vectors® Gold Miners ETF, EURO STOXX® Banks, SPDR® S&P® Oil & Gas Exploration & Production ETF Index y Materials Select Sector SPDR® Fund are concentrated in a single sector. Although an investment in the securities will not give holders any ownership or other direct interests in the stocks held by the VanEck Vectors® Gold Miners ETF, EURO STOXX® Banks, SPDR® S&P® Oil & Gas Exploration & Production ETF Index y Materials Select Sector SPDR® Fund, the return on an investment in the securities will be subject to certain risks associated with a direct equity investment in companies in a single sector. Accordingly, by investing in the securities, you will not benefit from the diversification which could result from an investment linked to companies that operate in a broader range of sectors. |

| § | Currency exchange risk. Because the prices of the equity securities included in the VanEck Vectors® Gold Miners ETF and iShares® MSCI Emerging Markets ETF son converted into U.S. dollars for purposes of calculating the level of the VanEck Vectors® Gold Miners ETF and iShares® MSCI Emerging Markets ETF, investors will be exposed to currency exchange rate risk with respect to each of the currencies in which the equity securities included in the VanEck Vectors® Gold Miners ETF y iShares® MSCI Emerging Markets ETF trade. Currency exchange rates may be highly volatile, particularly in relation to emerging or developing nations’ currencies and, in certain market conditions, also in relation to developed nations’ currencies. Significant changes in currency exchange rates, including changes in liquidity and prices, can occur within very short periods of time. Currency exchange rate risks include, but are not limited to, convertibility risk, market volatility and potential interference by foreign governments through regulation of local markets, foreign investment or particular transactions in foreign currency. These factors may adversely affect the values of the equity securities included in the VanEck Vectors® Gold Miners ETF and iShares® MSCI Emerging Markets ETF, the level of the VanEck Vectors® Gold Miners ETF and iShares® MSCI Emerging Markets ETF y the value of the securities. |

| § | Emerging markets risk. The iShares® MSCI Emerging Markets ETF is exposed to the political and economic risks of emerging market countries. In recent years, some emerging markets have undergone significant political, economic and social upheaval. Such far-reaching changes have resulted in constitutional and social tensions and, in some cases, instability and reaction against market reforms has occurred. With respect to any emerging market nation, there is the possibility of nationalization, expropriation or confiscation, political changes, government regulation and social instability. There can be no assurance that future political changes will not adversely affect the economic conditions of an emerging market nation. Political or economic instability could have an adverse effect on the performance of the securities. |

| § | There are risks associated with the VanEck Vectors® Gold Miners ETF, iShares® MSCI Emerging Markets ETF, SPDR® S&P® Oil & Gas Exploration & Production ETF y Materials Select Sector SPDR® Fund. A pesar de que shares of the VanEck Vectors® Gold Miners ETF, iShares® MSCI Emerging Markets ETF, SPDR® S&P® Oil & Gas Exploration & Production ETF y Materials Select Sector SPDR® Fund (each, a “Reference Fund”) are listed for trading on a national securities exchange and a number of similar products have been traded on various national securities exchanges for varying periods of time, there is no assurance that an active trading market will continue for the shares of the Reference Funds or that there will be liquidity in the trading market. Each Reference Fund is subject to management risk, which is the risk that a Reference Fund’s investment strategy, the implementation of which is subject to a number of constraints, may not produce the intended results. Pursuant to each Reference Fund’s investment strategy or otherwise, its investment advisor may add, delete or substitute the assets held by such Reference Fund. Any of these actions could adversely affect the price of the shares of each Reference Fund and consequently the value of the securities. For additional information on the Reference Funds, see “The Basket Components” herein. |

| § | The performance and market value of each Reference Fund, particularly during periods of market volatility, may not correlate to the performance of its Tracked Index. Each Reference Fund will generally invest in all of the equity securities included in the index tracked by such Reference Fund (each such index, a “Tracked Index”), but may not fully replicate such Tracked Index. There may be instances where a Reference Fund’s investment advisor may choose to |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

overweight another stock in such

Reference Fund’s Tracked Index, purchase securities not included in such Reference Fund’s Tracked Index that such investment

advisor believes are appropriate to substitute for a security included in such Tracked Index or utilize various combinations of

other available investment techniques. In addition, the performance of each Reference Fund will reflect additional transaction

costs and fees that are not included in the calculation of such Reference Fund’s Tracked Index. Finally, because the shares

of each Reference Fund are traded on a national securities exchange and are subject to market supply and investor demand, the market

value of one share of each Reference Fund may differ from the net asset value per share of such Reference Fund.

During periods of market volatility,

securities held by each Reference Fund may be unavailable in the secondary market, market participants may be unable to calculate

accurately the net asset value per share of such Reference Fund and the liquidity of such Reference Fund may be adversely affected.

This kind of market volatility may also disrupt the ability of market participants to create and redeem shares in each Reference

Fund. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing

to buy and sell shares of each Reference Fund. As a result, under these circumstances, the market value of shares of each Reference

Fund may vary substantially from the net asset value per share of such Reference Fund. For all the foregoing reasons, the performance

of each Reference Fund may not correlate with the performance of its Tracked Index. For additional information on the Reference

Funds, see “The Basket Components” herein.

| § | Hedging and trading activity. We, any dealer or any of our or their respective affiliates may carry out hedging activities related to the securities, including in the Reference Funds or instruments related to the Basket Components. We, any dealer or our or their respective affiliates may also trade in the Reference Funds or instruments related to the Basket Components from time to time. Any of these hedging or trading activities on or prior to the Trade Date and during the term of the securities could adversely affect our payment to you at maturity. |

| § | The estimated value of the securities on the Trade Date may be less than the Price to Public. The initial estimated value of your securities on the Trade Date (as determined by reference to our pricing models and our internal funding rate) may be significantly less than the original Price to Public. The Price to Public of the securities includes any discounts or commissions as well as transaction costs such as expenses incurred to create, document and market the securities and the cost of hedging our risks as issuer of the securities through one or more of our affiliates (which includes a projected profit). These costs will be effectively borne by you as an investor in the securities. These amounts will be retained by Credit Suisse or our affiliates in connection with our structuring and offering of the securities (except to the extent discounts or commissions are reallowed to other broker-dealers or any costs are paid to third parties). On the Trade Date, we value the components of the securities in accordance with our pricing models. These include a fixed income |

Because Credit Suisse’s pricing

models may differ from other issuers’ valuation models, and because funding rates taken into account by other issuers may

vary materially from the rates used by Credit Suisse (even among issuers with similar creditworthiness), our estimated value at

any time may not be comparable to estimated values of similar securities of other issuers.

| § | Effect of interest rate in structuring the securities. The internal funding rate we use in structuring notes such as these securities is typically lower than the interest rate that is reflected in the yield on our conventional debt securities of similar maturity in the secondary market (our “secondary market credit spreads”). If on the Trade Date our internal funding rate is lower than our secondary market credit spreads, we expect that the economic terms of the securities will generally be less favorable to you than they would have been if our secondary market credit spread had been used in structuring the securities. We will also use our internal funding rate to determine the price of the securities if we post a bid to repurchase your securities in secondary market transactions. See “—Secondary Market Prices” below. |

| § | Secondary market prices. If Credit Suisse (or an affiliate) bids for your securities in secondary market transactions, which we are not obligated to do, the secondary market price (and the value used for account statements or otherwise) |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

may be higher or lower than the

Price to Public and the estimated value of the securities on the Trade Date. The estimated value of the securities on the cover

of this pricing supplement does not represent a minimum price at which we would be willing to buy the securities in the secondary

market (if any exists) at any time. The secondary market price of your securities at any time cannot be predicted and will reflect

the then-current estimated value determined by reference to our pricing models and other factors. These other factors include our

internal funding rate, customary bid and ask spreads and other transaction costs, changes in market conditions and any deterioration

or improvement in our creditworthiness. In circumstances where our internal funding rate is lower than our secondary market credit

spreads, our secondary market bid for your securities could be more favorable than what other dealers might bid because, assuming

all else equal, we use the lower internal funding rate to price the securities and other dealers might use the higher secondary

market credit spread to price them. Furthermore, assuming no change in market conditions from the Trade Date, the secondary market

price of your securities will be lower than the Price to Public because it will not include any discounts or commissions and hedging

and other transaction costs. If you sell your securities to a dealer in a secondary market transaction, the dealer may impose an

additional discount or commission, and as a result the price you receive on your securities may be lower than the price at which

we may repurchase the securities from such dealer.

We (or an affiliate) may initially post a bid to repurchase

the securities from you at a price that will exceed the then-current estimated value of the securities. That higher price reflects

our projected profit and costs that were included in the Price to Public, and that higher price may also be initially used for

account statements or otherwise. We (or our affiliate) may offer to pay this higher price, for your benefit, but the amount of

any excess over the then-current estimated value will be temporary and is expected to decline over a period of approximately three

meses.

The securities are not designed to be short-term trading

instruments and any sale prior to maturity could result in a substantial loss to you. You should be willing and able to hold your

securities to maturity.

| § | Credit Suisse is subject to Swiss regulation. As a Swiss bank, Credit Suisse is subject to regulation by governmental agencies, supervisory authorities and self-regulatory organizations in Switzerland. Such regulation is increasingly more extensive and complex and subjects Credit Suisse to risks. For example, pursuant to Swiss banking laws, the Swiss Financial Market Supervisory Authority (FINMA) may open resolution proceedings if there are justified concerns that Credit Suisse is over-indebted, has serious liquidity problems or no longer fulfills capital adequacy requirements. FINMA has broad powers and discretion in the case of resolution proceedings, which include the power to convert debt instruments and other liabilities of Credit Suisse into equity and/or cancel such liabilities in whole or in part. If one or more of these measures were imposed, such measures may adversely affect the terms and market value of the securities and/or the ability of Credit Suisse to make payments thereunder and you may not receive any amounts owed to you under the securities. |

| § | Lack of liquidity. The securities will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the securities in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the securities when you wish to do so. Because other dealers are not likely to make a secondary market for the securities, the price at which you may be able to trade your securities is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the securities. If you have to sell your securities prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. |

| § | Potential conflicts. We and our affiliates play a variety of roles in connection with the issuance of the securities, including acting as calculation agent and as agent of the issuer for the offering of the securities, hedging our obligations under the securities and determining their estimated value. In performing these duties, the economic interests of us and our affiliates are potentially adverse to your interests as an investor in the securities. For instance, as calculation agent, Credit Suisse International will determine the Initial Component Level and the Payment at Maturity. Moreover, certain determinations made by Credit Suisse International, in its capacity as calculation agent, may require it to exercise discretion and make subjective judgments, such as with respect to the occurrence or non-occurrence of market disruption events and the selection of a successor basket component or calculation of the closing level in the event of a market disruption event or discontinuance of the Basket Components. Estas potentially subjective determinations may adversely affect the payout to you at maturity, if any. In addition, hedging activities by us or our affiliates on or prior to the Trade Date could potentially increase the Initial Component Level, and therefore, could increase the levels at or above which the Basket Components must close so that you are not exposed to the negative performance of the Basket on the Valuation Date. Further, hedging activities may adversely affect any payment on or the value of the securities. Any profit |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

in connection with such hedging

activities will be in addition to any other compensation that we and our affiliates receive for the sale of the securities, which

creates an additional incentive to sell the securities to you.

| § | Unpredictable economic and market factors will affect the value of the securities. The payout on the securities can be replicated using a combination of the components described in “The estimated value of the securities on the Trade Date may be less than the Price to Public.” Therefore, in addition to the levels of the Basket Components, the terms of the securities at issuance and the value of the securities prior to maturity may be influenced by factors that impact the value of fixed income securities and options in general such as: |

| o | the expected and actual volatility of the Basket Components; |

| o | the time to maturity of the securities; |

| o | the dividend rate on the equity securities included in the Basket Components; |

| o | interest and yield rates in the market generally; |

| o | investors’ expectations with respect to the rate of inflation; |

| o | events affecting companies engaged in the industries tracked by the VanEck Vectors® Gold Miners ETF, EURO STOXX® Banks Index, SPDR® S&P® Oil & Gas Exploration & Production ETF y Materials Select Sector SPDR® Fund; |

| o | geopolitical conditions and economic, financial, political, regulatory or judicial events that affect the components included in the Basket Components or markets generally and which may affect the level of the Basket; y |

| o | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

Some or all of these factors may influence the price

that you will receive if you choose to sell your securities prior to maturity. The impact of any of the factors set forth above

may enhance or offset some or all of any change resulting from another factor or factors.

| § | No ownership rights relating to the Basket Components. Your return on the securities will not reflect the return you would realize if you actually owned shares of the Reference Funds or the assets that comprise the Basket Components. The return on your investment is not the same as the total return you would receive based on the purchase of shares of the Reference Funds or the assets that comprise the Basket Components. For example, as a holder of the securities, you will not have voting rights or rights to receive cash dividends or other distributions or other rights with respect to shares of the Reference Funds or the assets that comprise the Basket Components. |

| § | Adjustments to the S&P 500® Value Index, the EURO STOXX® Banks Index or the Tokyo Stock Price Index could adversely affect the value of the securities. The publisher of the S&P 500® Value Index, the EURO STOXX® Banks Index or the Tokyo Stock Price Index (each, a “Reference Index”) may add, delete or substitute the component stocks of such Reference Index or make other methodological changes that could change the value of such Reference Index. Any of these actions could adversely affect the value of the securities. The publisher of a Reference Index may also discontinue or suspend calculation or publication of such Reference Index at any time. In these circumstances, Credit Suisse International, as the calculation agent, will have the sole discretion to substitute a successor underlying that is comparable to the discontinued Reference Index. Credit Suisse International could have an economic interest that is different than that of investors in the securities insofar as, for example, Credit Suisse International is permitted to consider Reference Indices that are calculated and published by Credit Suisse International or any of its affiliates. If Credit Suisse International determines that there is no appropriate successor underlying on the Valuation Date, the amount payable at maturity will be based on the value of the Reference Indices, based on the closing prices of the stocks constituting the Reference Indices at the time of such discontinuance, without rebalancing or substitution, |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

computed by Credit Suisse International

as calculation agent in accordance with the formula for calculating the Reference Indices last in effect prior to such discontinuance,

as compared to the Initial Basket Level.

| § | Anti-dilution protection is limited. The calculation agent will make anti-dilution adjustments for certain events affecting the Reference Funds. However, an adjustment will not be required in response to all events that could affect the Reference Funds. If an event occurs that does not require the calculation agent to make an adjustment, or if an adjustment is made but such adjustment does not fully reflect the economics of such event, the value of the securities may be materially and adversely affected. See “Description of the Securities—Adjustments” in the relevant product supplement. |

| § | The U.S. federal tax consequences of an investment in the securities are unclear. There is no direct legal authority regarding the proper U.S. federal tax treatment of the securities, and we do not plan to request a ruling from the Internal Revenue Service (the “IRS”). Consequently, significant aspects of the tax treatment of the securities are uncertain, and the IRS or a court might not agree with the treatment of the securities as prepaid financial contracts that are treated as “open transactions.” If the IRS were successful in asserting an alternative treatment of the securities, the tax consequences of the ownership and disposition of the securities, including the timing and character of income recognized by U.S. investors and the withholding tax consequences to non-U.S. investors, might be materially and adversely affected. Moreover, future legislation, Treasury regulations or IRS guidance could adversely affect the U.S. federal tax treatment of the securities, possibly retroactively. |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

Supplemental Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general

corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive

from the sale of the securities may be used in connection with hedging our obligations under the securities through one or more

of our affiliates. Such hedging or trading activities on or prior to the Trade Date and during the term of the securities (including

on any calculation date, as defined in any accompanying product supplement) could adversely affect the value of the Basket Components

and, as a result, could decrease the amount you may receive on the securities at maturity. For additional information, see “Supplemental

Use of Proceeds and Hedging” in any accompanying product supplement.

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

The Basket Components

S&P 500® Value Index

The S&P 500® Value Index is designed to measure

the full performance of companies included in the S&P 500® Index that exhibit relatively strong value characteristics

(determined by reference to (1) book-value-to-price ratio, (2) earnings-to-price ratio and (3) sales-to-price ratio) and relatively

weak growth characteristics (determined by reference to earnings-per-share growth, sales-per-share growth and upward share price

momentum) and a portion of the performance of companies with more balanced value and growth characteristics (where greater weight

is allocated to companies with relatively stronger value characteristics and relatively weaker growth characteristics).

The S&P 500® Value Index is a subset of the

S&P 500® Index and is a float-adjusted market-capitalization weighted index. S&P Dow Jones allocates the

complete float-adjusted market capitalization of the companies included in the S&P 500® Index between the S&P

500® Value Index and the S&P 500® Growth Index based on an assessment of those companies’

respective value and growth characteristics. The market capitalization of companies exhibiting the strongest value characteristics

relative to their respective growth characteristics is allocated to the S&P 500® Value Index (approximately

33% of the market capitalization of the S&P 500® Index), and the market capitalization of companies exhibiting

the strongest growth characteristics relative to their respective value characteristics (approximately 33% of the market capitalization

of the S&P 500® Index) is allocated to the S&P 500® Growth Index. The market capitalization

of the remaining companies included in the S&P 500® Index is split between the S&P 500® Valor

Index and the S&P 500® Growth Index, with more of the market capitalization of companies exhibiting stronger

value characteristics relative to their respective growth characteristics being allocated to the S&P 500® Valor

Index and more of the market capitalization of companies exhibiting the stronger growth characteristics relatively to their respective

value characteristics being allocated to the S&P 500® Growth Index.

For additional information about the S&P 500®

Value Index, see the information set forth under “The Reference Indices— The S&P Dow Jones Indices—The S&P

500® Index” in the accompanying underlying supplement.

Information as of market close on December 11, 2019:

| Bloomberg Ticker Symbol: | SVX |

| Current Closing Level: | 1252.733 |

| 52 Weeks Ago (on 12/12/2018): | 1052.641 |

| 52 Week High (on 11/27/2019): | 1254.547 |

| 52 Week Low (on 12/24/2018): | 942.574 |

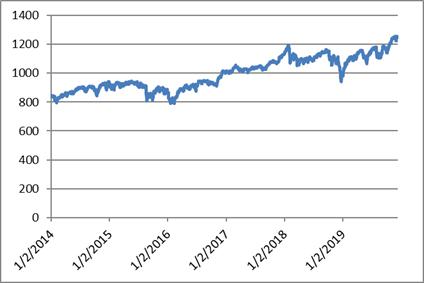

The following graph sets forth the daily closing levels of the

S&P 500® Value Index for the period from January 2, 2014 through December 11, 2019. The related table sets forth

the published high and low closing levels, as well as end-of-quarter closing levels, of the S&P 500® Value Index

for each quarter in the same period. The closing level of the S&P 500® Value Index on December 11, 2019 was

1252.733. We obtained the information in the table and graph below from Bloomberg Financial Markets without independent verification.

You should not take the historical values of the S&P 500® Value Index as an indication of its future performance,

and no assurance can be given as to the closing level of the S&P 500® Value Index on the Valuation Date.

For additional information about the S&P 500®

Value Index, see “The Reference Indices—The S&P Dow Jones Indices—The S&P 500® Index”

in the accompanying underlying supplement.

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

|

S&P 500® January 2, 2014 to December |

|

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

| S&P 500® Value Index | High | Low | Period End |

| 2014 | |||

| First Quarter | 860.390 | 793.810 | 860.390 |

| Second Quarter | 900.020 | 840.860 | 894.470 |

| Third Quarter | 911.420 | 868.990 | 891.110 |

| Fourth Quarter | 941.100 | 843.940 | 927.970 |

| 2015 | |||

| First Quarter | 937.940 | 885.530 | 915.870 |

| Second Quarter | 944.410 | 910.940 | 912.401 |

| Third Quarter | 932.160 | 810.100 | 831.710 |

| Fourth Quarter | 906.500 | 831.130 | 876.090 |

| 2016 | |||

| First Quarter | 892.210 | 788.670 | 888.950 |

| Second Quarter | 925.400 | 872.900 | 917.957 |

| Third Quarter | 950.180 | 909.110 | 938.797 |

| Fourth Quarter | 1015.670 | 908.365 | 1001.123 |

| 2017 | |||

| First Quarter | 1057.510 | 999.640 | 1027.883 |

| Second Quarter | 1045.549 | 1005.437 | 1037.134 |

| Third Quarter | 1066.458 | 1023.462 | 1066.458 |

| Fourth Quarter | 1132.272 | 1067.465 | 1126.982 |

| 2018 | |||

| First Quarter | 1195.510 | 1053.922 | 1080.053 |

| Second Quarter | 1112.310 | 1057.578 | 1088.212 |

| Third Quarter | 1164.959 | 1086.579 | 1144.503 |

| Fourth Quarter | 1153.173 | 942.574 | 999.699 |

| 2019 | |||

| First Quarter | 1124.977 | 980.028 | 1114.384 |

| Second Quarter | 1159.855 | 1067.766 | 1151.859 |

| Third Quarter | 1188.202 | 1103.459 | 1176.919 |

| Fourth Quarter (through December 11, 2019) | 1254.547 | 1139.981 | 1252.733 |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

VanEck Vectors® Gold Miners ETF

We have derived all information

contained herein regarding the VanEck Vectors® Gold Miners ETF from publicly available information. Such information

reflects the policies of, and is subject to change by, Van Eck Associates Corporation, which maintains and manages the VanEck Vectors®

Gold Miners ETF and acts as an investment advisor to the VanEck Vectors® Gold Miners ETF. We have not conducted

any independent review or due diligence of any publicly available information with respect to the VanEck Vectors®

Gold Miners ETF. The VanEck Vectors® Gold Miners ETF is an exchange-traded fund that seeks to replicate as closely

as possible, before fees and expenses, the price and yield performance of the NYSE Arca Gold Miners Index, which is a modified

market capitalization weighted index comprised of publicly traded companies involved primarily in the mining of gold and silver.

VanEck Vectors ETF Trust

is a registered investment company that consists of numerous separate investment portfolios, including the VanEck Vectors®

Gold Miners ETF. Information filed by VanEck Vectors ETF Trust with the SEC under the Securities Exchange Act and the Investment

Company Act can be found by reference to its SEC file numbers: 333-123257 and 811-10325. Shares of the VanEck Vectors®

Gold Miners ETF are listed on the NYSE Arca under ticker symbol “GDX.” Information from outside sources is not incorporated

by reference in, and should not be considered part of, this pricing supplement, the underlying supplement, any accompanying product

supplement, the prospectus supplement and the prospectus.

Information as of market close on December 11, 2019:

| Bloomberg Ticker Symbol: | GDX UP |

| Current Closing Level: | $27.71 |

| 52 Weeks Ago (on 12/12/2018): | $20.44 |

| 52 Week High (on 9/4/2019): | $30.95 |

| 52 Week Low (on 12/19/2018): | $19.95 |

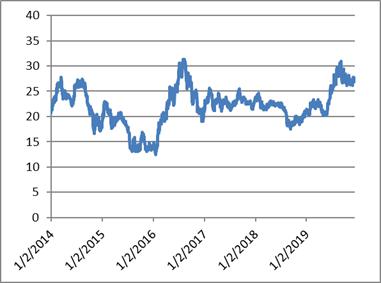

The following graph sets forth the daily closing levels of the

VanEck Vectors® Gold Miners ETF for the period from January 2, 2014 through December 11, 2019. The related table

sets forth the published high and low closing levels, as well as end-of-quarter closing levels, of the VanEck Vectors®

Gold Miners ETF for each quarter in the same period. The closing level of the VanEck Vectors® Gold Miners ETF on

December 11, 2019 was $27.71. We obtained the information in the table and graph below from Bloomberg Financial Markets without

independent verification. You should not take the historical values of the VanEck Vectors® Gold Miners ETF as an

indication of its future performance, and no assurance can be given as to the closing level of the VanEck Vectors®

Gold Miners ETF on the Valuation Date.

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

|

VanEck Vectors® January 2, 2014 to December |

|

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

| VanEck Vectors® Gold Miners ETF | High | Low | Period End |

| 2014 | |||

| First Quarter | $27.73 | $21.27 | $23.60 |

| Second Quarter | $26.45 | $22.04 | $26.45 |

| Third Quarter | $27.46 | $21.35 | $21.35 |

| Fourth Quarter | $21.94 | $16.59 | $18.38 |

| 2015 | |||

| First Quarter | $22.94 | $17.67 | $18.24 |

| Second Quarter | $20.82 | $17.76 | $17.76 |

| Third Quarter | $17.85 | $13.04 | $13.74 |

| Fourth Quarter | $16.90 | $13.08 | $13.72 |

| 2016 | |||

| First Quarter | $20.86 | $12.47 | $19.98 |

| Second Quarter | $27.70 | $19.53 | $27.70 |

| Third Quarter | $31.32 | $25.45 | $26.43 |

| Fourth Quarter | $25.96 | $18.99 | $20.92 |

| 2017 | |||

| First Quarter | $25.57 | $21.14 | $22.81 |

| Second Quarter | $24.57 | $21.10 | $22.08 |

| Third Quarter | $25.49 | $21.21 | $22.96 |

| Fourth Quarter | $23.84 | $21.42 | $23.24 |

| 2018 | |||

| First Quarter | $24.60 | $21.27 | $21.98 |

| Second Quarter | $23.06 | $21.81 | $22.31 |

| Third Quarter | $22.68 | $17.57 | $18.52 |

| Fourth Quarter | $21.09 | $18.39 | $21.09 |

| 2019 | |||

| First Quarter | $23.36 | $20.31 | $22.42 |

| Second Quarter | $26.17 | $20.17 | $25.56 |

| Third Quarter | $30.95 | $24.58 | $26.71 |

| Fourth Quarter (through December 11, 2019) | $28.36 | $26.19 | $27.71 |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

EURO STOXX® Banks Index

The EURO STOXX® Banks Index is a free-float market

capitalization index that currently includes 25 stocks of banks market sector leaders from 11 Eurozone countries: Austria, Belgium,

Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. Not all 11 countries are represented

in the EURO STOXX® Banks Index at any given time.

Information as of market close on December 11, 2019:

| Bloomberg Ticker Symbol: | SX7E |

| Current Closing Level: | 93.54 |

| 52 Weeks Ago (on 12/12/2018): | 92.09 |

| 52 Week High (on 4/17/2019): | 103.60 |

| 52 Week Low (on 8/15/2019): | 77.45 |

The following graph sets forth the daily closing levels of the

EURO STOXX® Banks Index for the period from January 2, 2014 through December 11, 2019. The related table sets forth

the published high and low closing levels, as well as end-of-quarter closing levels, of the EURO STOXX® Banks Index

for each quarter in the same period. The closing level of the EURO STOXX® Banks Index on December 11, 2019 was 93.54.

We obtained the information in the table and graph below from Bloomberg Financial Markets without independent verification. Tú

should not take the historical values of the EURO STOXX® Banks Index as an indication of its future performance,

and no assurance can be given as to the closing level of the EURO STOXX® Banks Index on the Valuation Date.

For additional information about the EURO STOXX®

Banks Index, see “EURO STOXX® Banks Index” in the accompanying underlying supplement.

|

EURO STOXX® January 2, 2014 to December |

|

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

| EURO STOXX® Banks Index | High | Low | Period End |

| 2014 | |||

| First Quarter | 156.58 | 139.31 | 155.26 |

| Second Quarter | 162.81 | 145.66 | 146.52 |

| Third Quarter | 154.60 | 135.67 | 149.21 |

| Fourth Quarter | 149.39 | 129.86 | 134.51 |

| 2015 | |||

| First Quarter | 158.53 | 124.29 | 157.65 |

| Second Quarter | 161.70 | 148.38 | 149.91 |

| Third Quarter | 161.45 | 128.04 | 131.34 |

| Fourth Quarter | 141.12 | 123.03 | 127.87 |

| 2016 | |||

| First Quarter | 125.04 | 89.65 | 101.38 |

| Second Quarter | 111.28 | 79.03 | 83.25 |

| Third Quarter | 99.11 | 78.37 | 92.54 |

| Fourth Quarter | 120.34 | 91.84 | 117.67 |

| 2017 | |||

| First Quarter | 127.52 | 111.98 | 127.52 |

| Second Quarter | 139.87 | 118.94 | 131.16 |

| Third Quarter | 139.91 | 127.83 | 138.38 |

| Fourth Quarter | 137.82 | 129.98 | 130.48 |

| 2018 | |||

| First Quarter | 143.05 | 123.72 | 125.69 |

| Second Quarter | 131.97 | 109.41 | 110.45 |

| Third Quarter | 116.73 | 104.16 | 106.55 |

| Fourth Quarter | 106.08 | 84.80 | 87.04 |

| 2019 | |||

| First Quarter | 98.51 | 86.61 | 93.25 |

| Second Quarter | 103.60 | 85.57 | 88.14 |

| Third Quarter | 92.04 | 77.45 | 87.70 |

| Fourth Quarter (through December 11, 2019) | 96.75 | 82.90 | 93.54 |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

iShares® MSCI Emerging Markets ETF

We have derived all information

contained herein regarding the iShares® MSCI Emerging Markets ETF from publicly available information. Such information

reflects the policies of, and is subject to change by, BlackRock Fund Advisors, which maintains and manages the iShares®

MSCI Emerging Markets ETF and acts as investment advisor to the iShares® MSCI Emerging Markets ETF. We have not

conducted any independent review or due diligence of any publicly available information with respect to the iShares®

MSCI Emerging Markets ETF. The iShares® MSCI Emerging Markets ETF is an exchange-traded fund that seeks to track

the investment results of the MSCI Emerging Markets Index, which is designed to measure equity market performance in the global

emerging markets.

iShares, Inc. is a registered

investment company that consists of numerous separate investment portfolios, including the iShares® MSCI Emerging

Markets ETF. Information filed by iShares, Inc. with the SEC under the Securities Exchange Act and the Investment Company Act can

be found by reference to its SEC file numbers: 033-97598 and 811-09102. Shares of the iShares® MSCI Emerging Markets

ETF are listed on the NYSE Arca under ticker symbol “EEM.” Information from outside sources is not incorporated by

reference in, and should not be considered part of, this pricing supplement or any accompanying underlying supplement, product

supplement, the prospectus supplement and the prospectus.

Information as of market close on December 11, 2019:

| Bloomberg Ticker Symbol: | EEM UP |

| Current Closing Level: | $43.68 |

| 52 Weeks Ago (on 12/12/2018): | $40.41 |

| 52 Week High (on 4/17/2019): | $44.59 |

| 52 Week Low (on 12/24/2018): | $38.16 |

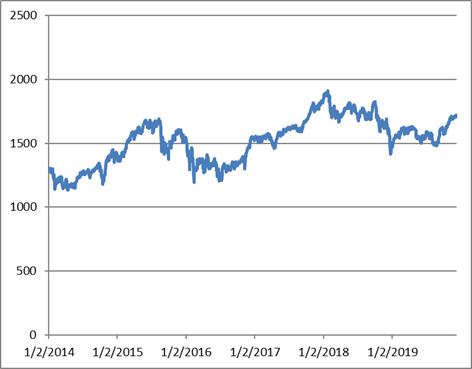

The following graph sets forth the daily closing levels of the

iShares® MSCI Emerging Markets ETF for the period from January 2, 2014

through December 11, 2019. The related table sets forth the published high and low closing levels, as well as end-of-quarter closing

levels, of the iShares® MSCI Emerging Markets ETF for each quarter

in the same period. The closing level of the iShares® MSCI Emerging Markets

ETF on December 11, 2019 was $43.68. We obtained the information in the table and graph below from Bloomberg Financial Markets

without independent verification. You should not take the historical values of the iShares®

MSCI Emerging Markets ETF as an indication of its future performance, and no assurance can be given as to the closing level

of the iShares® MSCI Emerging Markets ETF on the Valuation Date.

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

|

iShares® January 2, 2014 to December |

|

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

| iShares® MSCI Emerging Markets ETF | High | Low | Period End |

| 2014 | |||

| First Quarter | $40.99 | $37.09 | $40.99 |

| Second Quarter | $43.95 | $40.82 | $43.23 |

| Third Quarter | $45.85 | $41.56 | $41.56 |

| Fourth Quarter | $42.44 | $37.73 | $39.29 |

| 2015 | |||

| First Quarter | $41.07 | $37.92 | $40.13 |

| Second Quarter | $44.09 | $39.04 | $39.62 |

| Third Quarter | $39.78 | $31.32 | $32.78 |

| Fourth Quarter | $36.29 | $31.55 | $32.19 |

| 2016 | |||

| First Quarter | $34.28 | $28.25 | $34.25 |

| Second Quarter | $35.26 | $31.87 | $34.36 |

| Third Quarter | $38.20 | $33.77 | $37.45 |

| Fourth Quarter | $38.10 | $34.08 | $35.01 |

| 2017 | |||

| First Quarter | $39.99 | $35.43 | $39.39 |

| Second Quarter | $41.93 | $38.81 | $41.39 |

| Third Quarter | $45.85 | $41.05 | $44.81 |

| Fourth Quarter | $47.81 | $44.82 | $47.12 |

| 2018 | |||

| First Quarter | $52.08 | $45.69 | $48.28 |

| Second Quarter | $48.14 | $42.33 | $43.33 |

| Third Quarter | $45.03 | $41.14 | $42.92 |

| Fourth Quarter | $42.93 | $38.00 | $39.06 |

| 2019 | |||

| First Quarter | $43.71 | $38.45 | $42.92 |

| Second Quarter | $44.59 | $39.91 | $42.91 |

| Third Quarter | $43.42 | $38.74 | $40.87 |

| Fourth Quarter (through December 11, 2019) | $44.08 | $40.27 | $43.68 |

PLUS Based on the Value of a Weighted Basket Consisting of Seven Basket Components due July 6, 2020

Performance Leveraged Upside SecuritiesSM

Principal at Risk Securities

SPDR® S&P® Oil & Gas

Exploration & Production ETF

We have derived all information contained herein regarding the